Natural Gas News – January 13, 2025

Natural Gas News – January 13, 2025

Mansfield Market Assessment

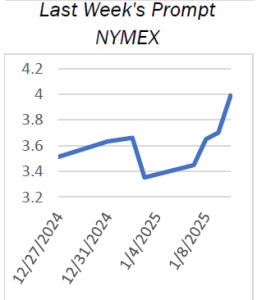

Recent weather forecasts have confirmed we can expect another wave of cold weather to arrive later this week. Natural gas traded up

to $4.40 overnight before consolidating around the $4.00 level. We are looking for a pattern breakdown soon which should result in a

selloff in the front month February contract. Producers are talking saying they need $5 dollar gas before any more investment can

happen to grow production to meet growing LNG demand. There is a scenario where the summer trades up to $4 dollars and stays there

as power demand should be thru the roof. Expect continued volatility as the market works through this next wave of cold weather with

some relief as it warms up closer to February.

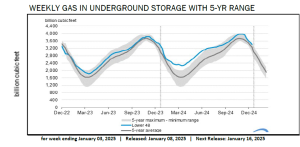

LNG Exports Hit Highs, Bolstering Futures Amid Tight Inventories

Natural gas futures surged past $3.76, hitting multi-week highs as frigid U.S. weather boosts demand and tightens inventories. LNG

exports to Europe hit record levels, driven by supply concerns and colder forecasts, amplifying U.S. market pressures. Weather models

project sustained cold across the U.S., with Arctic blasts next week driving demand and tightening storage. Analysts eye $4.20 as the

next resistance for natural gas prices, with bullish momentum dependent on continued demand strength. Volatile forecasts keep

traders cautious, with potential pullbacks if hedge funds take profits or weather trends suddenly warm. U.S. natural gas futures surged on Friday, breaking past the critical $3.766 pivot and hitting their highest levels since late December. This pivot now serves as strong… For more info go to https://tinyurl.com/mvw3ztn5

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.