Natural Gas News – November 25, 2024

Natural Gas News – November 25, 2024

Mansfield Market Assessment

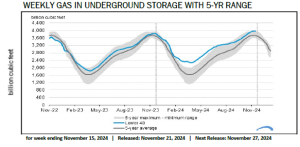

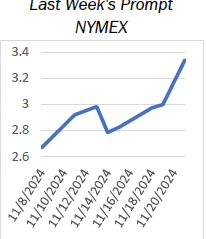

The weather models went colder over the weekend and in effect consolidated around a warm West Coast and cold Midwest and East thru the 11-15, Looks like the pattern could stick around thru the 16-20 day period. Currently the market is up .28 cents to 3.415 on the news. If we index up here, look for more Production to come online as well as, look for a very large storage draw the first week of Dec; possible 180+. Power burn will remain strong with the cold so demand will be high. As long as the models keep coming in cold during the back half of the runs the market will consolidate around the higher prices.

Can Futures Rebound Today with a Decisive Break Above $3.329?

U.S. natural gas futures recover after sell-off, with bulls eyeing $3.329 resistance for confirmation of market strength. Weather models forecast well-above-average HDDs for late November, driving higher heating demand across the U.S. this winter. The 50-day and 200-day moving averages emerge as critical support and resistance levels shaping the near-term price action. Natural gas demand forecast surges as cold fronts hit Midwest and Rockies, bringing lows down to -10°F to 20°F this week. A bearish market move looms if natural gas fails to hold $3.061, where multiple

support zones align with technical indicators. U.S. natural gas futures are edging higher on Monday, attempting to recover from Friday’s steep sell-off. Traders suggest the pullback was overdone, with price action hovering… For more info go to https://tinyurl.com/mthcc8ee

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.