Natural Gas News – November 11, 2024

Natural Gas News – November 11, 2024

Mansfield Market Assessment

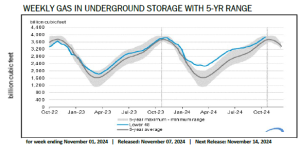

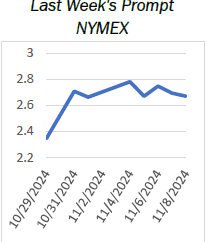

The weather turned a bit colder over the weekend, moving closer to the 10-year average for this time of year. While it’s not extremely cold yet, the market is on edge, as no one wants to be caught short when the real cold weather arrives. Marcellus production is down today, with only 32 Bcf/day being reported. The market is approaching the $3 mark, currently up 28 cents. We’ll have to see if this colder trend is just temporary or if it has some staying power. Given the reduced production levels, it seems unlikely that we’ll drop back down to test the lows.…

Futures Surge as Gulf Supply Disruptions Shake Market

Natural gas futures surge as Storm Rafael cuts 16% of Gulf supply, holding above $2.825 with resistance at $3.044 in sight. Storm Rafael shuts down a quarter of Gulf oil, disrupting 310 million cubic feet of natural gas and pushing futures higher. With Gulf production halted, natural gas futures eye $3.044 resistance. Support at $2.825 signals possible bullish momentum. Speculation over colder weather adds volatility to natural gas futures as traders await updated forecasts for clarity. Storm Rafael triggers production losses of 2.07 million barrels of oil and 1.12 billion cubic feet of natural gas in the Gulf. U.S. natural gas futures surged Monday, opening with a gap higher on the daily chart. This move confirms last Monday’s closing price reversal bottom at $2.514 but hasn’t yet shifted… For more info go to https://tinyurl.com/36ekbrvv

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.