Natural Gas News – November 4, 2024

Natural Gas News – November 4, 2024

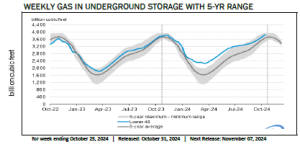

Mansfield Market Assessment

Natural Gas has trading down from the December settle and continues to show weakness. Freeport LNG tripped this weekend around 2.8 Bcf had to find a home between shut-ins and storage. Permian Highway is starting planned maintenance tomorrow which reduces Production down 2 Bcf. The Gulf Coast Express maintenance is now over bringing 1.6 Bcf back to the market. Cash around the grid is very week for tomorrow with key basins in the Northeast trading 1.10. Look for Production up there to scale back if we don’t see any weather which is not likely thru the end of the 11-15. We expect the market to grind lower unless something material changes in the near term.

Natural Gas Continues to See Support After Gapping Lower

The natural gas market gapped a bit lower during the early hours on Monday, but we have recovered quite a bit, and as I record this video, we are testing the 50-day EMA. All of that being said, if we can continue to go higher, then I think we will reenter the previous consolidation range, which of course makes a certain amount of sense. After all, this is a time of year where natural gas demand does tend to pick up a little bit. And furthermore, you also have to keep in mind that natural gas is a well-known cyclical market.So, a lot of traders will just simply jump in at a certain time of year and hang on to it like yours truly. Now that doesn’t mean that I do a lot of leverage with my position. It’s just a small part of my portfolio every year. So, I do think that we may try to build up… For more info go to https://tinyurl.com/sska8fje

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.