Natural Gas News – September 26, 2024

Natural Gas News – September 26, 2024

Prices Hold Steady as Traders Eye EIA Storage Report

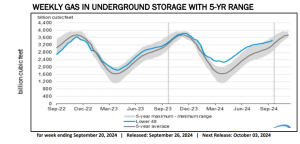

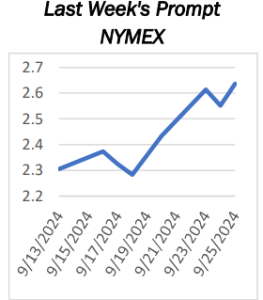

Natural gas prices hover flat as traders await EIA storage report, critical for short-term market direction. Key resistance at $2.937 and 200-day moving average may trigger short-seller action or potential breakout rally. Hurricane Helene disrupts production and demand, raising uncertainty in U.S. natural gas market forecasts. EIA report expected to show a 52 Bcf storage build; a surprise could spark intraday volatility in natural gas futures. U.S. natural gas prices traded flat on Thursday as market participants awaited the release of the weekly Energy Information Administration (EIA) storage report. The report, scheduled for 14:30 GMT, is expected to provide insight into the current supply levels, crucial for guiding near-term price direction. Early in the session, prices reached a three-month high but have… For more info go to https://tinyurl.com/3ahywaw7

Natural Gas Pops with European Gas Storage in the Balance

Natural Gas sees more and more tailwinds come in that could drive prices higher. Europe faces issues with colder temperatures revealing supply issues for the winter. The US Dollar Index is under pressure and falls to a 14-month low against the Euro. Natural Gas futures edge higher on Wednesday after a small pause in their rally the previous day. Heightened geopolitical tensions between Israel and Lebanon are still present, with supply concerns for Europe

emerging as well on top. The underground Gas stockpile reserves in Europe are nearly 94% full, which is an excellent level, though more concerning is that the stockpiling is not picking up anymore and is even seeing some drawdowns locally, which triggers concerns for reserves over the winter. Meanwhile, the US Dollar Index (DXY), which… For more info go to https://tinyurl.com/fd6tcnrz

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.