Natural Gas News – September 10, 2024

Natural Gas News – September 10, 2024

Winter’s Approach, Storm May Push Prices Toward $2.25 Barrier

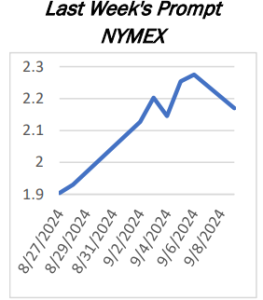

Natural gas prices have been under pressure due to weak demand from Asia and a decline in energy consumption in the U.S. and Europe. Additionally, the looming tropical storm Francine is expected to disrupt the natural gas supply in the U.S. as it potentially evolves into a hurricane. Francine, set to impact the US Gulf Coast this week, risks halting exports. Other factors affecting the prices include potential power outages and reduced demand for natural gas used in cooling systems as temperatures drop. Despite the potential disruptions in the U.S., natural gas prices in Europe may find support from increased demand due to colder weather. Night temperatures in Europe have been below seasonal norms, suggesting a colder winter ahead. The prospect of increased heating demand as temperatures fall may boost prices.… For more info go to https://tinyurl.com/2p5tbasy

Futures Rise as Traders Weigh Hurricane Impact

U.S. natural gas futures are trending higher on Monday as traders respond to conflicting weather reports and the potential impact of Hurricane Francine. After dipping to $2.158 earlier in the session, prices have recovered as the market weighs the effects of a possible hurricane in the Gulf of Mexico. The uncertainty revolves around whether the storm will disrupt production, pushing prices higher, or reduce demand by causing power outages and cooler temperatures. At 12:02 GMT, Natural Gas futures are trading $2.238, up $0.068 or +3.13%. The market has been volatile following the recent rally to $2.294 on Friday, as traders grapple with the potential effects of the hurricane. Analysts, including Eli Rubin of EBW Analytics, warn that Hurricane Francine could reduce demand, particularly in… For more info go to https://tinyurl.com/r8w8uuhe

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.