Natural Gas News – September 5, 2024

Natural Gas News – September 5, 2024

Will OPEC+ Delay Boost Oil Prices Amid Bearish Trends?

Oil prices saw a slight recovery after hitting multi-month lows, driven by expectations that OPEC+ may delay its planned output increase and falling U.S. crude inventories. The Organization of the Petroleum Exporting Countries (OPEC+) is reconsidering its scheduled October production hike due to weak Chinese demand and an easing of Libya’s export disruptions. Data from the American Petroleum Institute (API) showed a significant 7.4 million-barrel drop in U.S. crude stocks, offering further support. However, ongoing concerns about sluggish global demand, particularly from China, continue to limit price gains. Natural Gas (NG) is trading at $2.25, down by 0.49%, indicating a bearish trend on the 4-hour chart. The price action shows a clear resistance at $2.147, with NG forming a bearish engulfing pattern. A string of … For more info go to https://tinyurl.com/5dpcehpd

Nat-Gas Prices Jump as US Issues a New LNG Export Permit

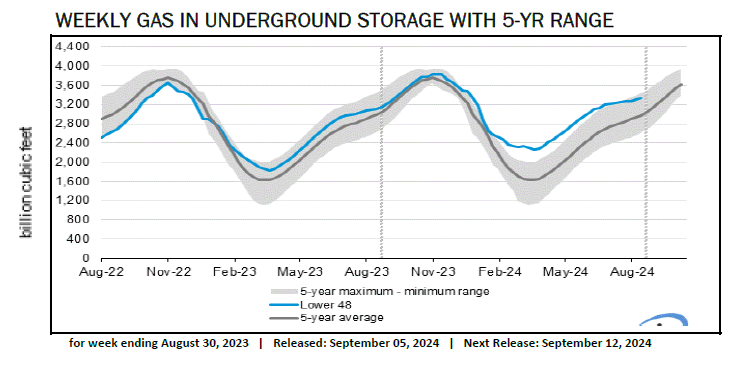

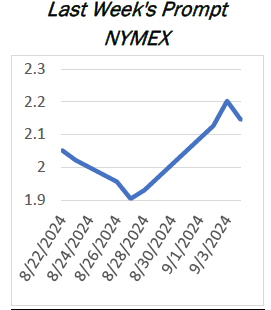

October Nymex natural gas (NGV24) on Tuesday closed up by +0.076 (+3.57%). Oct nat-gas prices Tuesday climbed to a 1-week high and settled sharply higher. Nat-gas prices rose after the US Department of Energy on Saturday awarded a five-year LNG export license to New Fortress Energy to sell gas to countries that do not have a free trade agreement with the US. This is the first time since January that the Energy Department has granted a LNG export license and is supportive of prices since an increase in LNG exports could reduce US nat-gas supplies and shrink elevated inventories. Last Wednesday, nat-gas prices sank to a 4-month low due to robust supplies and forecasts for moderate temperatures that will reduce nat-gas demand. US nat-gas supplies as of August 23 were +12.1% above their 5-year… For more info go to https://tinyurl.com/7ch5enva

This article is part of Daily Natural Gas Newsletter

Tagged: natural gas

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.