Natural Gas News – September 3, 2024

Natural Gas News – September 3, 2024

Natural Gas Continues to Attempt a Recovery

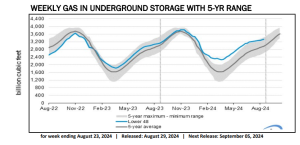

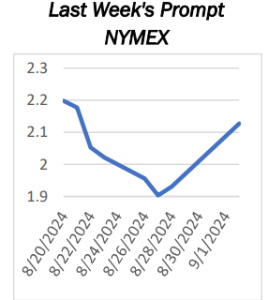

Natural gas markets look a little stretched on early Monday, but really at this point, you have to keep in mind also that Monday was Labor Day in the United States and Canada. So, a huge swath of those who would be trading this market are gone. The futures markets of course, focus on overnight electronic trading. So, you can only read so much into that. And at this point in time, it does look like we are trying to dig into an area that previously had been significant resistant. As you know, I have been advocating for low leverage and more of an investment approach to natural gas in order to take advantage of the cyclical swing higher. I don’t know that we are there yet.So, at this point in time on short-term pullbacks, I like the idea of buying ETF positions, if you will, just to keep the leverage down. And that… For more info go to https://tinyurl.com/457pzktc

Brent Plunges Below $75 as Bearish Sentiment Builds

Oil prices fell early on Tuesday with Brent breaking below the $75 threshold for the first time this year as concerns about global oil demand continued to trump Libya’s production decline. As of 9:21 a.m. EDT on Tuesday, Brent Crude had slumped by 3.47% at $74.79. The U.S. benchmark, WTI Crude, was down by 2.98% on the day to trade at $71.30.Signals from OPEC+ sources that the group would proceed with a gradual easing of the cuts in October have already depressed oil prices and market sentiment at the end of last week. At the start of this week, oil remained under pressure on Monday in lighter Labor Day trade in New York. Prices were weighed down by the latest economic data from China, which showed that factory activity continues to contract. This weekend, the official Purchasing

Managers’… For more info go to https://tinyurl.com/34vamxu6

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.