Natural Gas News – August 1, 2024

Natural Gas News – August 1, 2024

Futures Edge Up Pre-EIA Report, Bearish Fundamentals Loom

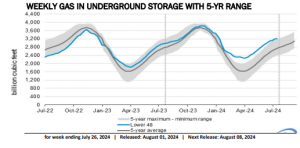

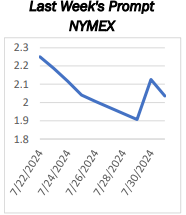

Natural gas futures inch higher as traders await EIA storage report; market poised for potential short-covering rally. Bearish fundamentals persist despite technical rebound hopes. Production levels above 102 Bcf/d fuel ongoing supply surplus concerns. Weather forecast: Hot high pressure to dominate US. Analysts predict

EIA storage injection of 30-34 Bcf, slightly below 5-year average; market expectations lean towards +30 Bcf. U.S. natural gas futures are showing slight gains as traders anticipate the release of the weekly Energy Information Administration (EIA) storage report. The market is attempting to stabilize above Tuesday’s closing price

reversal bottom of $1.991, which could potentially trigger a short covering rally if sustained. At 12:51 GMT, Natural Gas futures are trading $2.078, up $0.042 or +2.06%… For more info go to https://tinyurl.com/2cuvwz9j

West Virginia gas production rises sharply during full month of MVP

Natural gas production in West Virginia has stepped up notably since long-term contracts on the new Mountain Valley Pipeline started July 1, while spreads between Appalachian Basin gas hubs and the new Transco station 165 price have narrowed toward the end of the month. MVP was placed into service June 14 and offered interruptible and short-term firm capacity for the rest of that month before long-term firm capacity obligations began July 1. Flows on the pipeline into its terminus at the Cherrystone interconnect with Transco averaged around 500 MMcf/d June 15-30 and picked up to almost 1 Bcf/d in July, Commodity Insights data showed. The extra

flows have coincided with a sharp uptick in regional production, particularly in the West Virginia side of the Marcellus Shale. Production in the… For more info go to

https://tinyurl.com/y722saxn

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.