Natural Gas News – July 25, 2024

Natural Gas News – July 25, 2024

Futures Mixed as Traders Await EIA Storage Report

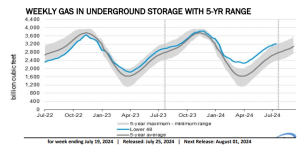

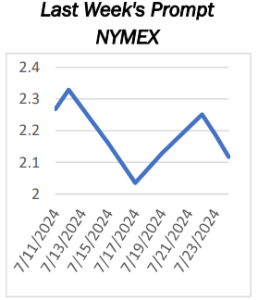

Natural gas futures show mixed performance ahead of EIA storage report, pivoting around $2.143 for direction. EIA storage report expected to show +13 Bcf build, influenced by cooling degree days and increased wind energy. High-pressure systems to drive temperatures into the 90s-100s, boosting natural gas demand across most of the US. EQT Corp. reaffirms 2024 sales volumes, signaling ongoing supply curtailments to balance the natural gas market. EQT CEO warns of “skyrocketing” prices if a fracing ban is implemented, stressing the impact on US production. Natural gas futures are showing mixed performance on Thursday as traders await the Energy Information Administration’s (EIA) weekly storage report, scheduled for release at 14:30 GMT. The market is currently pivoting around $2.143, a level that could determine the … For more info go to https://tinyurl.com/bdnr4em6

European Natural Gas Prices Fall as Freeport LNG Resumes Operations

European natural gas prices fell sharply after the Freeport LNG export facility restarted operations. The restart of Freeport LNG eased concerns about supply shortages in Europe. European gas storage levels are high, reducing the risk of a gas crisis this winter. Europe’s benchmark natural gas prices slumped on Monday to the lowest level in one week after the U.S. export facility Freeport LNG resumed some operations following a shutdown due to Hurricane

Beryl earlier this month. The Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, were down by 2.7% at $34.09 (31.31 euros) per megawatt-hour (MWh) at 10:54 a.m. in Amsterdam on Monday. Last week, the supply disruptions from Freeport LNG and heat waves across a large part of Europe pushed up European

natural gas prices. A… For more info go to https://tinyurl.com/bdzzsypb

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.