Natural Gas News – June 25, 2024

Natural Gas News – June 25, 2024

Heat Wave Boosts Cooling Demand Nationwide

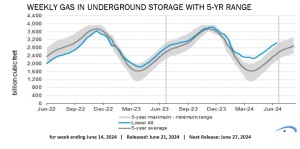

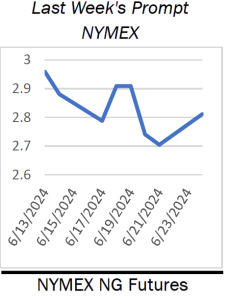

Natural gas futures indicate an uptrend, driven by increasing cooling demand despite early declines. A heat wave in the southern U.S. pushes natural gas futures higher as cooling demand rises. The market approaches the 200-day moving average, suggesting possible bullish momentum for traders. Natural gas futures are signaling a potential upward trend, despite a slight decline in early Tuesday trading. Recent market behavior indicates a shift in focus from production levels to increasing cooling demand, potentially impacting storage surpluses. At 13:01 GMT, Natural Gas Futures are trading $2.758, down $0.053 or -1.89%. Monday’s session saw a dramatic reversal, with futures rebounding from early lows. This shift is largely weather-related, driven by forecasts of extreme heat across the southern two-thirds of the U.S.… For more information, go to https://tinyurl.com/3scr66yh

China’s LNG imports set to slow

LONDON, June 24 (Reuters) – China appears to have taken advantage of low prices in the spot market so far in 2024 to boost the amount of gas in storage, absorbing some of the extra fuel that would otherwise have been sent to Europe.

But as storage facilities fill and spot prices rise, the intake is likely to taper over the summer, redirecting more liquefied natural gas (LNG) cargoes to Europe and accelerating the fill rate at the other end of Eurasia. To the frustration of foreign analysts, China does not publish statistics on gas, oil or coal inventories, which are considered commercially sensitive and a matter of national security. But the country consumed a record 55 million metric tons of gas from overland pipelines and sea-borne LNG in the first five months of 2024, according to data … For more information, go to https://tinyurl.com/yeye8mw4

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.