Natural Gas News – May 14, 2024

Natural Gas News – May 14, 2024

Overbought Conditions, Technical Reversal Capping Gains

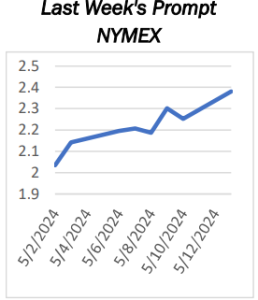

Natural gas futures took a downward turn, influenced by signs of a potential bearish trend, notably highlighted by a closing price reversal top last Friday. This movement is largely seen as a technical correction, likely triggered by overbought market conditions. At 12:40 GMT, Natural Gas is trading $2.243, down $0.009 or -0.40%. The

start-of-the-week shift in natural gas prices often correlates with changes in the weekend weather forecast. Today’s price action suggests a possible move towards milder temperatures, typically associated with decreased demand for natural gas. Despite Friday’s lower close, natural gas futures ended the week on a strong note, propelled by diminishing production levels and robust demand from liquefied natural gas (LNG) exports. This momentum marks the second consecutive week of gains, a… For more info go to https://tinyurl.com/yc6yp4y7

Dilemmas in LNG Term Deals Amid Higher Henry Hub Forward Curves

As international LNG prices show signs of stabilizing following market fluctuations triggered by tensions between Russia and Ukraine, coupled with several contracts nearing expiration around 2024 and 2025, Asian buyers have initiated negotiations for long-term contracts, or LTCs, since the beginning of 2024. According to market data, approximately ten LTCs have been signed since January 2024, with three or more involving Henry Hub linkage. Several market sources indicated that Asian buyers signing contracts based on DES (delivered ex-ship) terms linked to Henry Hub have negotiated contract slopes ranging between 119% and 121%. The pricing mechanism includes a constant factor to cover liquefaction and freight costs, estimated to be around $4.5/MMBtu, partially tied to the consumer price… For more info go to https://tinyurl.com/bdz9mk9v

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.