Natural Gas News – May 9, 2024

Natural Gas News – May 09, 2024

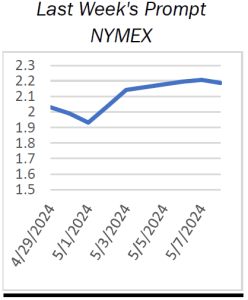

Energy Prices Climb Over 0.25%; More Upside Ahead?

Oil prices tick up as U.S. mediates potential Israel-Hamas ceasefire, markets watch closely. China’s oil imports dip in April despite stronger overall economic indicators, suggesting demand cooling. High interest rates suppress oil demand; future rate cuts or OPEC+ cuts could stabilize markets. Oil prices increased slightly in Asian markets on Thursday after mixed trade data from China and as geopolitical tensions in the Middle East remained high. The possibility of a ceasefire between Israel and Hamas was a focal point, particularly with the U.S. intensifying efforts to mediate.

This context saw Brent oil futures rise to $83.92 and West Texas Intermediate to $79.41 per barrel. However, a decline in China’s oil imports in April, despite stronger overall imports, suggested a potential cooling in the world’s largest… For more information, go to https://tinyurl.com/4matf7m2

Natural Gas shoots higher with Egypt securing border its Northern Sinai border

Natural Gas prices are trading higher with Egypt shoring up controls at Northern Sinai border. Traders are adding risk premium as diplomatic tensions grow on Israel. The US Dollar Index dips below 105.00 with markets piling into earlier rate cut bet. Natural Gas (XNG/USD) trades substantially higher on Monday with markets adding a chunky risk premium after Israel started the next phase of its offensive around the city of Rafah. This adds to more upside forces in gas prices this Monday.

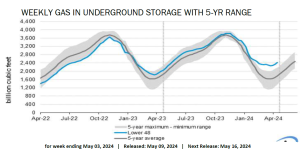

However, on the other hand, European Gas storages are filled up by 63.25%, seeing net inflows as the peak demand season draws to a close and limit big upside moves for now. Meanwhile, the US Dollar Index (DXY) is erasing earlier gains and switched to red numbers with the US session set to start for this week… For more information, go to https://tinyurl.com/k4tj7cnr

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.