Middle East Tensions, OPEC+ Talks, and Regulatory Changes Fuel Oil Price Shifts

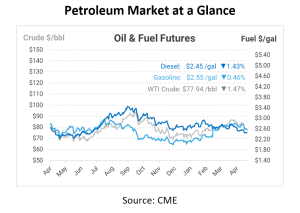

The global oil markets witnessed modest fluctuations this morning, as crude futures declined slightly, reflecting a trend of recent volatility. Brent crude futures were down to $82.77 a barrel, while West Texas Intermediate (WTI) fell to $77.94. These movements come in the wake of heightened geopolitical tensions in the Middle East, particularly around the Gaza Strip, where Israeli forces have escalated military operations. Despite ongoing efforts to secure a ceasefire with Hamas, the situation remains unstable, impacting oil prices, which are sensitive to regional disruptions.

In addition to geopolitical factors, the oil market is also influenced by strategic decisions within OPEC+. Ahead of their meeting in June, there is speculation about whether OPEC+ will adjust their production outputs. A recent Bloomberg report highlighted that OPEC+ is still analyzing the possibility of increasing crude oil output, a topic that remains contentious among member states.

On the regulatory side, significant developments are shaping the industry’s operational landscape. The U.S. Environmental Protection Agency (EPA) issued a final rule on May 6, enhancing methane reporting requirements for the oil and gas industry. This new regulation, which will be phased in during 2024 and 2025, mandates more accurate emission calculations and direct monitoring of key emission sources, aiming to significantly reduce methane emissions as part of broader climate change initiatives.

Furthermore, market dynamics are affected by China’s response to a growing surplus of fuel due to increased adoption of new energy vehicles. The Chinese government has issued a second fuel-export quota, allowing the export of an additional 14 million tons of diesel, gasoline, and jet fuel. This increase brings this year’s total export quota to 33 million tons, up 18% from last year, indicating significant shifts in global fuel supply and demand dynamics.

As market stakeholders anticipate the upcoming U.S. inventory reports, expected declines in crude oil and product stockpiles could influence future pricing and market strategies. With Saudi Arabia recently raising the official selling prices for June-loading cargoes to the highest level in five months, and ongoing adjustments in global production and regulatory frameworks, the oil market remains a complex environment fraught with both challenges and opportunities.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.