Oil Prices Expected to Remain Above $80 in 2024

In a year marked by geopolitical tensions and strategic production cuts, oil prices are anticipated to sustain levels above $80 a barrel. According to the latest Reuters oil poll, analysts have adjusted their 2024 forecasts for Brent and West Texas Intermediate (WTI) crude, underscoring the ongoing challenges and risks shaping the global oil market.

The poll, which included 43 economists and analysts, suggests that Brent crude will average $84.62 a barrel in 2024, up from a previous consensus of $82.33. This adjustment marks the second consecutive upward revision this year, with Brent prices averaging around $83.50. Similarly, forecasts for WTI have been raised to $80.46 a barrel from the earlier prediction of $78.09.

Factors Driving the Forecast

Analysts attribute this outlook to a combination of higher-than-anticipated demand and ongoing supply restrictions. Suvro Sarkar, energy sector team lead at DBS Bank and one of the analysts surveyed by Reuters, explained that oil market fundamentals remain tighter than expected in the first half of the year. He added, “Demand trends have been more positive than expected, which should continue to support oil prices through inventory drawdowns, especially given the extended OPEC+ supply cuts.”

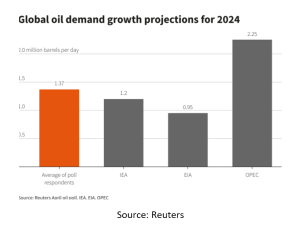

The International Energy Agency (IEA) aligns with this view, reporting that global oil demand growth is consistent with pre-COVID trends. The IEA projects a rise in global oil demand by 1.2 million barrels per day (mbpd) in 2024, with most poll respondents forecasting demand increases between 0.9 and 1.4 mbpd.

Geopolitical Risks and Supply Dynamics

The ongoing conflict in the Middle East and the resultant geopolitical risks are significant factors underpinning these forecasts. Analysts at the Economist Intelligence Unit highlight that global oil demand is poised to reach another record high, driven by robust consumption in developing nations. These dynamics are expected to maintain a floor under oil prices, with most analysts agreeing that a rise to $100 a barrel is unlikely despite the volatility.

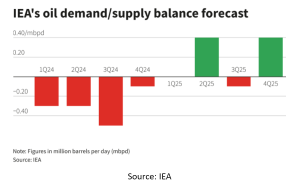

On the supply side, the OPEC+ group, led by Saudi Arabia and Russia, is anticipated to continue its production cuts beyond June. This decision is likely to keep the supply-demand balance in deficit. However, while U.S. oil production is expected to grow, the emphasis on prioritizing shareholder returns over production expansion in the U.S. shale industry could temper this growth.

As the year progresses, the oil market continues to face a complex interplay of heightened demand and constrained supply, influenced significantly by geopolitical instability and strategic production decisions. While the forecasts suggest stability above $80 a barrel, the market remains sensitive to any significant geopolitical developments or changes in production strategies by major oil-producing nations.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.