Week in Review – May 3, 2024

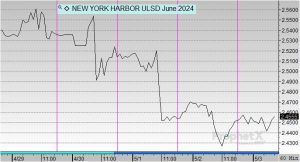

Oil ticked up slightly on Friday but was still poised for its sharpest weekly decline in three months, burdened by worries over demand and elevated interest rates. On Thursday, futures for NYMEX ULSD dropped to their lowest since last July, while RBOB futures increased by 5-12 cents per gallon. The June ULSD contract decreased by 88 cents, closing at $2.44/gal, with spot prices declining in almost all U.S. markets except for San Francisco, where distillate spot prices jumped by over 9 c/gal.

This decline in distillate prices impacts the market for renewable diesel, with diesel crack spreads on the Gulf Coast reaching the high teens. This shift could lower the prices of renewable fuels in various markets.

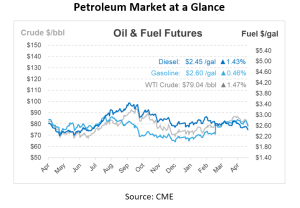

Meanwhile, both WTI and Brent are on track to close down this week, with the NYMEX June contract for WTI crude oil dropping a few cents yesterday to close at $78.95/bbl. July Brent crude increased on Thursday by over 20 cents, finishing at $83.67/bbl. The market’s structure shows a minimal speculative bias towards long positions in crude, making it less prone to the typical vulnerabilities seen in early May when long positions are often sold off.

Gasoline consumption in the US has dropped to its lowest seasonal point since 2020, diverging from the usual increase observed as the summer driving season approaches. According to the EIA, this measure of demand has decreased for four consecutive weeks, reaching levels not seen since the onset of the Covid lockdowns.

Crude oil inventories have had an unexpected rise, with five builds occurring in the past six weeks. Despite this increase in crude stocks, there wasn’t a corresponding build in gasoline and diesel inventories, even though refinery utilization dropped by 1%. This imbalance contributed to a downward trend in market prices. Diesel inventories have also shown improvement. Since the beginning of 2022, the days of supply for distillate fuels have been trending upward, reflecting the reduced demand for these fuels.

The EIA chart below on fuel demand shows a decline, as highlighted in a recent report which noted that over the past four weeks, the supply of motor gasoline averaged 8.6 Mbpd, a decrease of 3.6% from the same period last year. Similarly, distillate fuel supply averaged 3.5 Mbpd, down 8.2% from last year.

The additional risk to oil prices from the conflict between Israel and Hamas has lessened as both parties explore a temporary ceasefire and engage in discussions with international mediators. The upcoming OPEC+ meeting is scheduled in a few weeks for June 1. Sources within the OPEC+ group indicate that the current voluntary reduction in oil output, which amounts to 2.2 Mbpd, may continue past June if there is no uptick in oil demand.

Prices in Review

Crude opened on Monday at $83.69 and tapered off each day of the week. This morning, crude opened at $79.07, a decrease of $4.62 or -5.52%.

On Monday diesel opened at $2.5441 and also experienced losses throughout the week. This morning, diesel opened at $2.4531, a decrease of 9 cents or -3.58%.

Gasoline opened on Monday at $2.763 and dropped slightly each day of the week. This morning, gasoline opened at $2.5989, a decrease of 16 cents or -5.93%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.