Natural Gas News – March 28, 2024

Natural Gas News – March 28, 2024

Are Lower Lows On The Horizon

On February 7, in a Barchart article that asked, “How low can natty gas go,” I wrote: Natural gas is a volatile energy commodity that tends to take no prisoners when it decides to move higher or lower. One of the most significant factors for the path of least resistance of prices is if the market becomes overly long or short. In February 2024, speculators are short. The extent of those risk positions could determine the path of least resistance of prices and if the energy commodity could stage a substantial rally over the coming weeks and months. Natural gas’s penchant for price variance means all risk positions require a plan with risk-reward horizons. While altering the plan’s dynamics when natural gas prices move in the anticipated direction is acceptable, adjust stops to protect profits and capital.

When the… For more info go to https://tinyurl.com/ycxzvmux

Testing Multi-Year Low

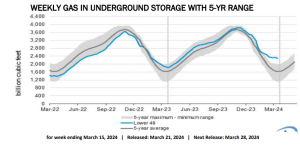

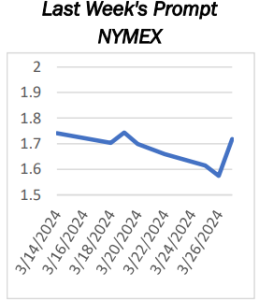

US Natural Gas futures are slightly higher on Thursday as traders await the latest US Energy Information Administration (EIA) storage report. Despite the potential for short-term fluctuations, the market is expected to continue its current trend, influenced by weather conditions and storage levels. Although today’s report could fuel a

knee-jerk counter-trend rally. At 13:08 GMT, Natural Gas Futures are trading $1.740, up $0.022 or +1.28%. Recent weather reports from NatGasWeather indicate most of the US experiencing warmer temperatures, with some cooler exceptions in the Southwest and Northern Plains. This mild weather reduces the need for heating, contributing to a surplus in natural gas storage, currently estimated at +674 billion cubic feet (Bcf). The anticipated storage draw is

around … For more info go to https://tinyurl.com/bdzv4ub9

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.