Week in Review – March 29, 2024

US markets are closed today in observance of the Good Friday holiday. Trading activities will resume operations on Monday, April 1.

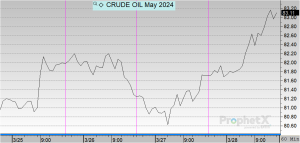

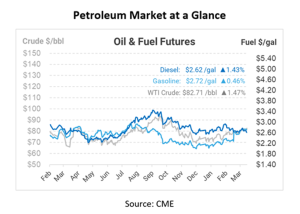

Petroleum futures experienced an upward shift on Thursday, breaking a two-day losing streak and leading to a rise in gasoline and crude oil prices over the week. Crude oil is poised to conclude the first quarter of 2024 on a high note, with an approximate 16% increase from the year’s outset. The May contract for the U.S. benchmark WTI crude climbed $1.82, closing at $83.17 per barrel, and marked a 3.1% gain for a shortened trading week. Meanwhile, the June contract increased by $1.64 to $82.42 per barrel.

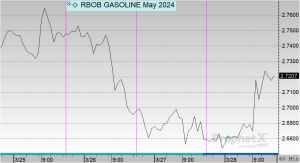

ULSD prices are dipping heavily, dropping in six of the previous eight sessions. Yesterday, the April contract for ULSD saw a slight rise of 1.7 cents, settling at $2.6156 per gallon, yet ended the week down by 1.4%. The May contract improved by 2.02 cents to $2.6227 per gallon. These gains followed the release of the latest data from the EIA, which revealed increases in U.S. crude and gasoline inventories. The market is also navigating challenges from a stronger dollar, making energy contracts pricier for traders paying with foreign currencies.

Price increases are further fueled by expectations of a seasonal uptick in demand and reports suggesting that OPEC and its allies might maintain voluntary production cuts until their June meeting, maintaining tightness in global crude supplies.

A surge in California gasoline prices was noted as the EIA reported a decrease of 1 million barrels in West Coast gasoline inventories, with several refineries in the area expected to commence maintenance work in the forthcoming weeks.

The collapse of the Francis Scott Key Bridge into the Patapsco River on Tuesday, which has led to a temporary cessation of all shipping traffic from the Port of Baltimore, has consequential implications for energy-related trade in the US. Being the second-largest coal exporting hub in the country, this disruption is poised to impact coal exports.

Furthermore, the Port of Baltimore plays a crucial role in the importation of refined petroleum products, including biodiesel feedstock, which averaged 3,000 bpd in 2023, mainly from Central America and Western Europe. The port’s status as the leading importer of asphalt from Canada and a significant importer of urea ammonium nitrate, a common liquid fertilizer mostly from Russia, proves its importance to various sectors, including construction and agriculture. The collapse is likely to cause a decline in bunker fuel consumption due to reduced freight and bulk vessel transit, while prompting a search for alternative ports for the importation of crucial commodities like asphalt and urea ammonium nitrate, potentially straining other ports on the U.S. Atlantic Coast. While more widely used petroleum products seem less affected, the overall impact highlights the interconnectedness of infrastructure, energy markets, and supply chains.

Prices in Review

Crude opened the week at $80.85 and traded within a dollar a barrel over the short trading week. This morning, crude opened at $81.71, an increase of 86 cents or 1.0636%.

Diesel opened the week at $2.6644, climbed slightly on Tuesday, and tapered off the rest of the week. This morning, diesel opened at $2.6047, a decrease of 6 cents or -2.24%.

Gasoline opened the week at $2.7353 and also rose slightly on Tuesday before dropping back off the rest of the week. This morning, gasoline opened at $2.6789, a decrease of 5 cents or -2.06%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.