Natural Gas News – February 20, 2024

Natural Gas News – February 20, 2024

Warm Winter Drags U.S. Natural Gas

One of the warmest winters on record in the United States has created a natural gas glut, dragging benchmark gas prices to their lowest levels in three decades and prompting producers, who were pumping at record rates, to scale back drilling activity. The front month U.S. benchmark price at the Henry Hub settled on Friday at its lowest level since 1995 – except for a few days during peak pandemic in 2020. Record domestic natural gas production has also added to the glut, but now some of the major producers are hitting the brakes on drilling and completion activity and reducing rig numbers in response to unsustainably low natural gas prices. Despite the constant retirement of coal-fired power capacity, demand for natural gas for electricity and space heating has been lower this winter due to the warmer-than-normal … For more info go to http://tinyurl.com/yc4phjjt

Natural Gas Prices Forecast: ‘Oversold’ Conditions

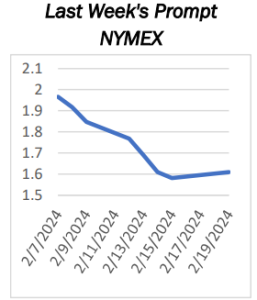

US natural gas prices are experiencing volatility early Tuesday, marked by a recent decline following a holiday-induced gain. This fluctuation signals traders’ efforts to pinpoint a market bottom amidst technical oversold indicators. Concurrently, fundamental constraints, like limited control over production and external policies, add to the market’s unpredictability. At 14:22 GMT, Natural Gas Futures are trading $1.593, down $0.016 or -0.99%. Tuesday’s early price action in US natural gas indicates a potential bottoming out. The market is currently oversold, a technical term describing a situation where, over a 14-day period, prices drop significantly. However, true oversold

conditions arise only when selling pressure eases, particularly when hedge funds halt their long position liquidation… For more info go to http://tinyurl.com/22kkmdrm

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.