Refinery Utilization Drops and Its Impact on Fuel Futures

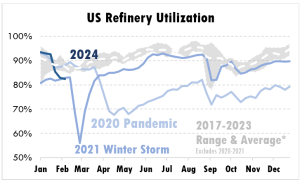

The energy market is experiencing another significant drop in refinery utilization, a trend that has been observed in recent weeks. Refinery utilization is the percentage of total operating capacity that refiners use, since it’s challenging to run their equipment at 100% all the time. While some of the previous declines were attributed to cold weather, we are now entering a period marked by additional planned refinery downtime.

Planned downtimes are essential for refiners to conduct maintenance before the upcoming spring and summer gasoline driving season, when refiners must increase throughput to keep up with high demand. While there are some anticipated improvements in refinery utilization as winter unplanned issues are resolved, the pressure from planned downtime is expected to persist through April.

However, U.S. refiners had previously reduced output due to cold weather, resulting in the lowest crude runs since January 2023. Refinery utilization rates declined by 2.6 percentage points to 82.9% in the same week, according to the EIA.

Diesel and Gasoline Futures

The impact of declining refinery utilization is particularly evident in the futures market. Diesel futures are trading higher due to a substantial decrease in diesel inventory levels. On the other hand, gasoline futures are trading lower, reflecting the changing dynamics in the industry.

According to Andy Milton, Vice President of Supply and Distribution at Mansfield Energy, one notable factor to monitor in the futures market is backwardation. “We are monitoring backwardation. For ULSD futures, March-April spreads are 6 cents and widening slightly. At this point, there are no major supply concerns,” explained Milton on January 31, 2024. Since that time, the spread between March and April has increased as high as 9 cents per gallon.

Regional Variations

The fuel inventory situation also varies by region. In PADD 2 (Midwest), diesel inventory remains near 5-year highs, with this region being the only one to see inventory growth in recent weeks. Meanwhile, in PADD 1 (East Coast), diesel inventory levels are near 5-year lows, highlighting regional disparities in supply and demand.

Notably, implied distillates demand on a four-week rolling basis experienced a significant increase of more than 8%, the largest single-week rise since October 2022. This surge in demand was partly driven by a cold snap that boosted heating demand, even in a relatively mild winter. Distillate inventory decreased, particularly on the East Coast and Gulf Coast, further illustrating the changing dynamics in the market.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.