Natural Gas News – January 30, 2024

Natural Gas News – January 30, 2024

Natural Gas Prices Forecast: Will Cooler Weather

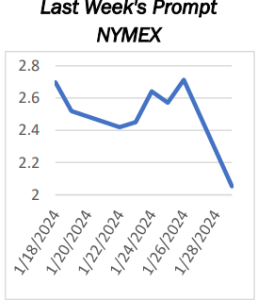

U.S. natural gas futures experienced a notable rise last week, closing at $2.712, up by $0.193 or +7.66%. This surge to a one-week high was primarily driven by forecasts of higher demand due to slightly cooler weather predictions and the gradual recovery of output following early January’s Arctic freeze. As traders anticipate changes in weather conditions, this upswing reflects the market’s sensitivity to both environmental factors and supply trends. Demand forecasts show significant variability in response to shifting weather patterns. LSEG projects that natural gas demand in the Lower 48 states will drop from the current level of 144.6 billion cubic feet per day (bcfd) to 124.9 bcfd next week. However, a rise to 127.8 bcfd is expected within two weeks as cooler weather sets in. This fluctuating demand

aligns clo… For more info go to http://tinyurl.com/mrxxuk7v

US Pause On LNG Exports Raises Pressure On Canada

WINNIPEG, Manitoba, Jan 29 (Reuters) – U.S. President Joe Biden’s decision to pause expansion of American liquefied natural gas (LNG) exports has raised pressure from environmental groups on the British Columbia and Canadian governments to do the same, although following suit may be politically difficult. British Columbia (B.C.) will hold an election in October, and its left-leaning New Democrat government is expected to decide late this year whether to approve Ksi Lisims’ 12 million-metric ton export facility. It would become Canada’s second-largest LNG terminal and also requires federal approval. Canada’s first significant LNG exports may begin this year with the Shell-led (SHEL.L), opens new tab LNG Canada facility more than 90% built. A second phase under consideration by LNG Canada th… For more info go to http://tinyurl.com/5n7e8z6y

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.