How Internal Carbon Pricing Can Empower the Green Energy Shift

In today’s ever-evolving corporate landscape, where environmental sustainability takes center stage, businesses are discovering an innovative way to make a positive impact: internal carbon pricing. But what exactly does this mean, and how does it translate into real change?

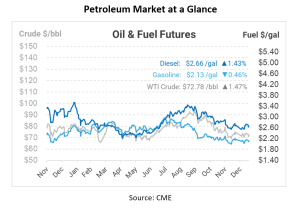

Picture this: a forward-thinking company sets an internal price for carbon emissions. This price tag, while symbolic in nature, can carry significant financial implications. It’s not just about calculating the cost of carbon; it’s about using that financial mechanism to drive change. One of the ways is in the support for renewable diesel. In regions where renewable diesel adoption faces economic hurdles, companies can step in and utilize their internal carbon pricing mechanism to fund the purchase of renewable diesel. This isn’t just about being eco-conscious; it’s about reshaping the energy landscape.

By committing to internal carbon pricing, a company can turn its investment on renewable diesel in areas that still lack incentives, like the Low Carbon Fuel Standard (LCFS). Therefore, what seemed economically implausible becomes financially viable. It’s a win-win situation. Companies reduce their carbon footprint, and regions without established green energy incentives can get a chance to embrace renewable diesel.

Internal Carbon Pricing – Getting it Right

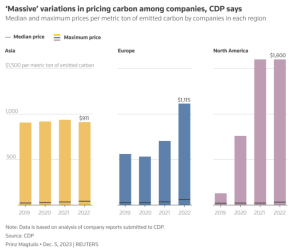

While there is no one-size-fits-all approach to establishing a global carbon price, the adoption of internal carbon pricing and determining the correct price for carbon emissions is crucial for the success of the initiative. Analysts have long cautioned that setting carbon prices too low can expose companies to accusations of greenwashing – appearing environmentally responsible without making substantial changes. On the other hand, excessively high carbon prices can disrupt a company’s investment strategy and financial stability. Striking the right balance is a delicate task, emphasizing the need for companies to set realistic targets that they can genuinely achieve. The range of internal carbon prices currently adopted by companies is vast, spanning from less than $1 per metric ton to over $1,000 per metric ton.

One notable trend in the realm of sustainability leadership is the growing partnership between sustainability leaders and their internal finance teams. This collaboration has a singular objective: to quantify how carbon emissions impact the organization’s financial bottom line. Establishing a clear link between emissions and financial consequences can help companies set more plausible prices for their internal emissions, grow their sustainability initiatives, and foster new strategies – including the use of Renewable Diesel – as mentioned before.

According to the non-profit organization CDP, 20% of global companies that disclose climate-related information have already implemented an internal carbon price. Furthermore, an additional 22% are actively planning to implement it within the next two years. This indicates a growing recognition among businesses of the importance of carbon pricing in achieving sustainability goals.

What is a carbon footprint?

The first step to setting a price for your carbon emission is knowing your company’s carbon footprint. A carbon footprint refers to the total amount of greenhouse gases (GHGs), primarily carbon dioxide (CO2), and other emissions produced directly or indirectly by a company. It is a crucial metric for evaluating the environmental impact of an operation or product. You can learn more about Carbon Footprint here.

Ready to learn your carbon footprint? Click here to access the calculator on the Mansfield Energy website. Then, inform the type of fleet your business uses and how many vehicles you have in your fleet. You can also include your fleet’s annual diesel volume to get an even more tailored answer.

Mansfield Solution

Reducing your fleet’s footprint isn’t just about fulfilling environmental responsibilities; it’s also a strategic business move in a world increasingly focused on sustainability. If you are a fleet looking for a greener solution to fuel up your vehicles, reach out to Mansfield today to discover a full range of products and services designed to help you meet your sustainable goals.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.