Week in Review – January 19, 2024

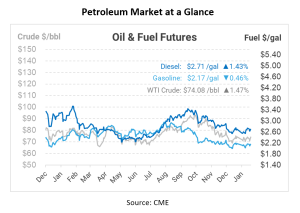

Oil markets experienced a relatively stable start on Friday, with Brent crude futures holding at $79.06 and the US West Texas Intermediate crude futures (WTI) at $72.02, both heading for a weekly gain. This resilience comes in the face of a complex web of factors influencing prices, including Middle East tensions and oil output disruptions caused by cold weather in the US. As of Wednesday, approximately 40% of oil output in North Dakota remained offline due to severe cold weather conditions.

One notable observation in the market structure is the premium of the first-month Brent contract to the six-month contract, which rose to as much as $2.15 a barrel on Friday. This structure, known as backwardation, indicates a perception of tighter supply for prompt delivery, which further supports the notion that supply disruptions are a significant concern.

For the week, the U.S. benchmark is poised to rise approximately 1.6%, while Brent is expected to gain slightly less than 1%. These gains were triggered after the International Energy Agency (IEA) raised its 2024 oil demand growth forecast, providing some optimism for the industry.

However, it’s essential to note that despite the IEA’s higher demand growth forecast, it remains significantly lower than the projection made by the producer group OPEC, which also emphasized that barring significant disruptions to flows, the market appeared reasonably well supplied in 2024.

According to research company IIR Energy, U.S. oil refiners are anticipated to have approximately 1.5 million barrels per day of their capacity offline for the week ending January 19. This reduction in available refining capacity amounts to a decrease of 992,000 bpd. Looking ahead, IIR predicts that offline capacity will increase slightly to 1.60 million bpd in the week ending January 26 before decreasing to 1.56 million bpd in the subsequent week. These fluctuations in refining capacity are essential indicators for understanding the dynamics of the US oil industry and its ability to meet domestic and global energy demands.

Despite the ongoing Middle East tensions not resulting in the shutdown of any oil production, supply disruptions persist in Libya. As of Wednesday, approximately 40% of oil output in North Dakota, one of the leading oil-producing states in the U.S., remained offline due to severe cold weather conditions.

The Red Sea Conflict

On Thursday, Houthi militants in Yemen launched missiles at an American-owned commercial vessel, the Chem Ranger, marking the third attack in the Red Sea.

The missiles, identified as anti-ship ballistic missiles, struck the water near the ship, according to US Central Command. Fortunately, there were no reported injuries or damage to the vessel. This incident occurred on the same day President Joe Biden acknowledged that US airstrikes against the Houthis had not succeeded in halting their attacks.

The ongoing threat to commercial shipping in the Red Sea is causing disruptions to shipments of goods and posing a potential challenge to efforts to curb food inflation. In response to these escalating attacks, the Biden administration has reversed its previous decision to remove the Houthis from the global terrorism list, seeking to cut off their funding sources and address the security concerns in the region.

Prices in Review

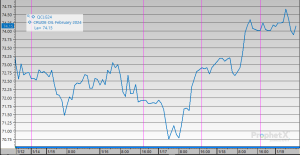

Crude opened the week at $72.02. On Tuesday, it had increased slightly to $72.17. However, Wednesday saw a dip to $71.18. The trend reversed on Thursday when crude oil surged to $73.32. This morning, it opened at $74.14, an increase of $2.12 or 2.94%.

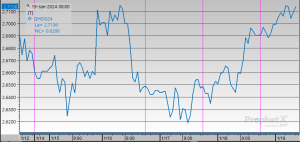

Diesel opened the week at $2.6513. By Tuesday, the price increased to $2.6996, but on Wednesday, it dropped to $2.6306. Thursday saw another increase, reaching $2.6593This morning, diesel prices opened at $2.7112, an increase of $0.0599 or 2.26%.

On Monday, gasoline started at $2.1199 and gained a few cents on Tuesday. However, on Wednesday, it experienced a drop to $2.0997. On Friday, gasoline opened at $2.1762, an overall gain of $0.0563 or 2.65%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.