Natural Gas News – January 9, 2024

Natural Gas News – January 9, 2024

Natural Gas Signals Bullish Momentum, Eyes 3.04 Price Target

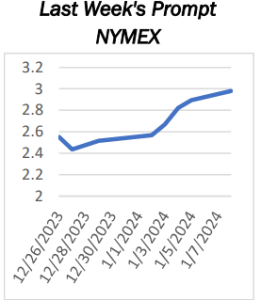

Natural gas triggers a bullish trend continuation signal on Monday as it trades above last week’s high of 2.91. Subsequently, selling set in, with the price of natural gas falling intraday to test support of the past couple of trading days. Buyers stepped up again near lows of the day to take natural gas back up above last week’s high again, which is where it remains at the time of this writing. Such an intraday flush out and recovery rally bodes well for the bulls in the foreseeable future as the sellers were in control for a while, but they could not maintain control. Natural gas is now on track to close strong, in the top third of the day’s range and above last week’s high. The 50% retracement at 2.94 was exceeded today with a strong close above that level a real possibility. Moreover, Monday may end with a… For more info go to https://shorturl.at/

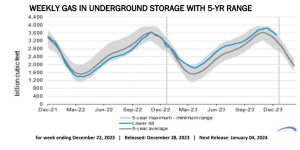

Winter Weather Set To Narrow US Gas Storage Surplus

The US gas storage surplus could narrow by triple digits over the next several weeks as frigid weather fuels a major spike in domestic heating demand, resetting the market outlook for the balance of winter. Current forecasts call for below-normal temperatures to sweep most of the country through at least the third week of January, including in the Midwest, where dozens of cities experienced their warmest Christmas holidays on record. Over the coming weekend, the region could see temperatures fall as much as 20 degrees below normal, while temperatures in the Rockies and Southeast are also forecast to trail regional averages, according to data from S&P Global Commodity Insights. Overall, nearly the entire Lower 48 can expect to see below-normal temperatures Jan. 13-21, with Midwest states… For more info go to https://shorturl.at/gyES1

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.