Natural Gas News – December 14, 2023

Natural Gas News – December 14, 2023

Investors Turn Bearish on European Natural Gas Amid

Ample inventories and muted demand so far this winter heating season have turned portfolio managers bearish on European natural gas for the first time since September and benchmark prices are now down to a four-month low. At the end of last week, hedge funds and other money managers held a net short position in the Dutch TTF Natural Gas Futures, the benchmark for Europe’s gas trading, according to data from exchanges released on Wednesday and reported by Bloomberg. High inventories, eased fears of supply shortages, weak demand, and increased confidence that Europe could go through the winter without major supply disruptions have all led to a drop in Europe’s natural gas prices in the past two weeks. The winter premiums in the futures and options market have all but vanished in recent days. The front-month Dutch TT… For more info go to https://shorturl.at/ijtyW

Natural Gas Prices Forecast: Pressured by Bearish EIA

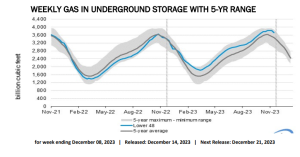

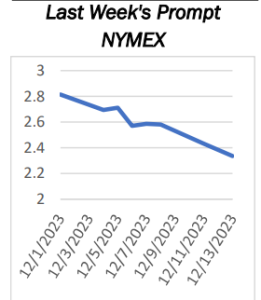

Natural gas futures are poised to open lower on Wednesday, influenced by bearish factors such as the latest EIA outlook report and forecasts for warmer US temperatures. January futures are currently trading at $2.292, reflecting a decrease. The US is set to experience milder temperatures, particularly in the southern regions, leading to a very light demand for natural gas in the next seven days, according to NatGasWeather.com. Over the next two weeks, warmer than-normal temperatures are expected across most of the US, reducing heating demand significantly. This weather outlook, coupled with the EIA’s prediction of record-high US natural gas output, is exerting downward pressure on prices. The market is responding to these developments with natural gas futures hovering just above $2.30 per … For more info go to https://shorturl.at/CGLPX

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.