What is it – Commodity Futures Trading Commission (CFTC)

Oil futures are a driving force in the global economy, impacting everything from the price at the pump to international trade policies. Because the derivatives market is so complex, we will be exploring the topic of financial oversight by spotlighting the CFTC, a cornerstone agency in the regulatory landscape. Understanding the CFTC’s function is key to grasping how the heartbeat of the global economy is monitored and maintained.

What is the CFTC?

Established in 1974, the Commodity Futures Trading Commission (CFTC) is an independent U.S. federal agency with a mission as robust as the markets it oversees. It is tasked with regulating the U.S. derivatives markets, which encompass futures, swaps, and certain kinds of options. Think of it as the financial market’s referee, ensuring fair play, transparency, and the prevention of fraud and manipulation.

Comprised of five commissioners, the positions are selected by the US President and must be confirmed by the Senate for a five-year term. Leadership within the commission is decided by the President, who appoints one commissioner as the chair. To ensure political balance, no more than three commissioners may simultaneously belong to the same political party.

These commissioners work across various specialized committees that focus on sectors like agriculture, energy, environmental markets, global markets, market risk, and technology. The committees are not just internal; they consist of a diverse range of stakeholders from the industry. This includes industry experts, traders, representatives from futures and commodities exchanges, consumer advocates, and environmentalists, all contributing to a broad spectrum of perspectives on the CFTC’s oversight and regulatory efforts.

How Does the CFTC Work?

The CFTC works by enforcing rules laid out in the Commodity Exchange Act. It requires the registration of all firms and individuals who wish to conduct business in the derivatives market. The registration and examination of these entities are overseen by the National Futures Association (NFA) under the watchful eye of the CFTC.

The CFTC publishes weekly reports known as the Commitments of Traders (COT), which shine a light on the positions held by different traders, providing transparency and insights into market dynamics.

In collaboration with other regulatory bodies like the Securities and Exchange Commission (SEC), the CFTC plays a pivotal role in the prevention of systemic risk. Its regulations are designed to protect the integrity of the markets and the individuals and businesses that depend on them.

The CFTC and Oil Markets

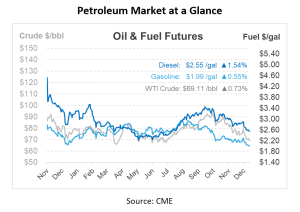

The CFTC’s relationship with the oil markets is particularly significant. Oil futures are a critical component of the energy sector, acting as a measure of global economic health. The CFTC monitors these markets to prevent excessive speculation and manipulation that could lead to price volatility independent of supply and demand fundamentals. By keeping a vigilant eye on the markets, the CFTC helps maintain stability in the pricing of oil, which in turn affects everything from the gas at your local station to the cost of heating homes and operating businesses.

Bringing the CFTC Full Circle

As mentioned above, the CFTC publishes the Commitment of Traders (COT) report weekly as a tool that encapsulates the CFTC’s mission of fostering market transparency and providing insights into the US futures market. With its roots stretching back to 1924, this report initially offered insights into hedging and speculation in the futures market. Now, as a weekly publication, it reflects the importance of the fast-paced nature of futures trading.

At its core, the COT report offers a snapshot of the aggregate holdings of various market participants as of the preceding Tuesday. This data, meticulously compiled and verified before release, serves as a barometer for the market’s pulse. The inclusion of open interest data for futures and options markets where significant trader activity is observed provides a comprehensive overview, essential for both traders and researchers. The graphical representation of this data enhances its utility, offering a clear, visual interpretation of market trends.

For traders, the COT report is a guide to shaping their trading strategies, aiding in decisions on whether to adopt a short or long position. However, it’s important to note that the report, in adherence to legal and confidentiality considerations, does not divulge individual trader positions. This aspect, while essential for maintaining business privacy, does attract criticism. Critics argue that the COT, designed to enhance market transparency, is shrouded in regulatory opacity.

The COT stands as a testament to the CFTC’s commitment to providing clarity and direction in a market that is inherently complex and dynamic. As such, the COT report is not just a publication but a driver of futures market understanding and transparency, bringing the CFTC’s objectives full circle in the realm of oil futures trading.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.