EIA Forecasts Global Fuel Production Growth for 2024

The U.S. Energy Information Administration (EIA) has released its November Short-Term Energy Outlook, offering insights into global energy markets and their potential implications.

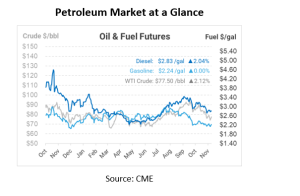

In terms of global oil supply, the report forecasts a 1.0 million barrels per day (b/d) increase in global liquid fuels production in 2024. However, this growth will be influenced by ongoing production cuts by the OPEC+ alliance, which aims to maintain a balanced global oil market. Geopolitical conflicts, such as the recent events involving Israel and Hamas, could potentially exert upward pressure on crude oil prices, although no significant production disruptions have occurred so far.

The EIA expects the Brent crude oil price to rise from an average of $90 per barrel (b) in the fourth quarter of 2023 to an average of $93/b in 2024, reflecting the equilibrium between supply and demand in the global oil market.

Within the United States, a noteworthy trend is the projected 1% decline in gasoline consumption for 2024. This decrease would result in the lowest per capita gasoline consumption in two decades, driven by remote work arrangements, improved vehicle fuel efficiency, high gasoline prices, and persistent inflation.

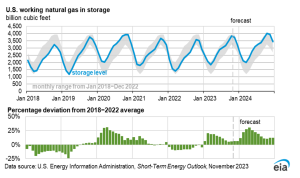

The natural gas sector in the U.S. reveals that natural gas inventories are estimated to be 6% above the five-year average as of the end of October, thanks to high natural gas production and warmer-than-average winter weather. The Henry Hub spot price is projected to average near $3.20 per million British thermal units (MMBtu) in November, down from the previous year’s price of almost $5.50/MMBtu, reflecting supply-demand dynamics.

The EIA’s Short-Term Energy Outlook provides crucial insights into the anticipated trends in fuel prices, availability, and market dynamics. As the energy landscape undergoes shifts in response to factors like geopolitical tensions and environmental concerns, staying updated helps businesses adapt and plan for potential disruptions in their fuel supply, ensuring the continued efficiency and sustainability of their operations.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.