US Oil Market: Global Integration and Market Realignment

The US oil market, once tied to the fluctuations of Cushing, Oklahoma, famously known as the “Pipeline Crossroads of the World,” is undergoing a deep transformation. For decades, Cushing’s inventory levels served as a reliable gauge for domestic supply and demand dynamics. However, as the United States becomes increasingly intertwined with the global oil market, the role of Cushing is shifting.

Today’s article will explore the evolving dynamics of the US oil market, offering insights into the implications for traders and market participants while examining recent price trends, data, forecasts, and the emergence of crude oil bears.

More about Cushing

Cushing, a modest town in Oklahoma, has played an important role in the US crude oil market. Its extensive network of tank farms and pipelines made it a strategic hub for traders, especially due to the convergence of pipelines from the prolific Permian Basin shale fields in Texas and New Mexico. Additionally, the pricing of the NYMEX contract for US benchmark West Texas Intermediate (WTI) crude was traditionally established at Cushing.

However, the traditional reliance on Cushing as the primary barometer for the US crude oil market is eroding due to many factors.

- Surge in US Exports: Since the export ban was lifted in 2015, the United States has substantially increased its crude oil exports, reaching more than 4 million barrels a day to key markets in Europe and Asia. This development has shifted attention away from Cushing, with traders now closely monitoring the Gulf Coast, the country’s primary export center.

- Inclusion in Dated Brent: Earlier this year, American oil was incorporated into the calculation of Dated Brent, the world’s foremost physical oil benchmark. This shift has further redirected focus away from Cushing and towards the global oil market.

- Transformation of Trading Patterns: While Cushing’s inventories have just recently rebounded from precarious lows, crude oil prices have felt some bearish pressure lately. This peculiar disconnect between tight physical inventories and bearish trading patterns presents an unexpected challenge for market participants actively engaged in risk management and trading strategies.

The Emergence of the Crude Oil Bears

In recent weeks, the US oil market has witnessed the emergence of crude oil bears, driven by a combination of factors, including a slowing global economy, increased non-OPEC output, and skepticism regarding OPEC+ production cuts. Hedge funds and other money managers have sold significant volumes of petroleum-related futures and options contracts, with some weeks seeing substantial crude oil sales.

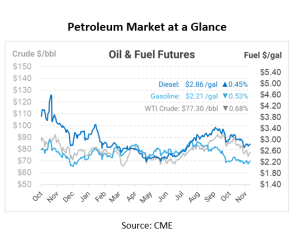

Bullish long positions have decreased, with bearish shorts gaining prominence. Despite a supply deficit due to OPEC+ cuts in the fourth quarter and potential supply disruptions in the Middle East, oil prices have dropped more than 15% from their peak in September. Brent crude futures, for example, fell to around $82 a barrel from a 2023 high in September of nearly $98.

Amid these market shifts, production dynamics are also evolving. Russia, for instance, has reduced its seaborne crude exports, with the four-week average falling to 3.23 million barrels per day, down by 200 kbpd from the period to November 12th and the lowest level since August 20th. Meanwhile, Iran has reported production forecasts of 3.6 million barrels per day in March 2024, and a 4 million-barrel increase in 2025. The country reported that output had risen from 2.3 million barrels per day to 3.4 million barrels per day currently.

As America’s role in global markets continues to grow, it is increasingly likely that futures trading will mirror supply and demand conditions at the US Gulf Coast rather than focusing solely on Cushing. This transformation may usher in a more nuanced and intricate oil market, where traders must adapt to new signals and indicators to navigate successfully.

Therefore, traders and market participants must evolve alongside these shifts and embrace a more comprehensive approach to understanding the intricacies of the US oil market in a global context. The emergence of crude oil bears adds another layer of complexity to this evolving market, where prices, data, and forecasts all reflect these shifting tides.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.