Natural Gas News – November 16, 2023

Natural Gas News – November 16, 2023

Natural Gas Prices Forecast: Heightened Volatility Expected

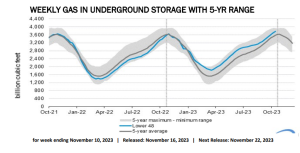

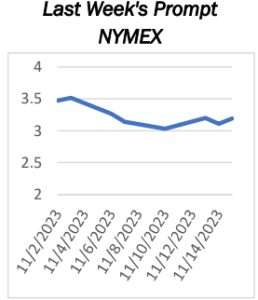

U.S. natural gas futures are experiencing an uptick ahead of two pivotal U.S. Energy Information Administration (EIA) weekly storage reports, due to be released at 15:30 GMT and 16:00 GMT, respectively. Market analysts anticipate volatile trading, with the release of two simultaneous EIA reports, a rarity in market trends. EIA Reports Predict Varied Storage Dynamics The first of the two EIA reports, delayed from last week, is expected to show a draw of -6 to -7 billion cubic feet (Bcf), significantly below the 5-year average of +36 Bcf. This forecast reflects the impact of colder temperatures. Conversely, the regular report for this week projects a substantial build, ranging from +32 to +44 Bcf, most notably at +40-44 Bcf, against a 5-year average of +20 Bcf. NatGasWeather forecasts for November 16-22 predict warm… For more info go to https://shorturl.at/jpKVW

Europe Energy Crisis: Have Natural Gas Prices Peaked?

Whilst crude produced some price swings, it has been, of late, the natural gas prices that have absorbed most of the impact as a result of the conflict in the Middle East. Natural gas prices were 15% higher in October. At one point, they rallied by 40% to touch an eight-month high – and given the geopolitical conflict is happening against the backdrop of a slowing economy, it is imperative to ask what will be the direction of gas markets moving forward, especially in Europe? In case of a full blown war, as estimated by Bloomberg Economics, we can see the global economy tipping into a recession wiping off $1 trillion and oil prices touching $150. Naturally this would cause gas markets to skyrocket as well. In fact, even more. However, the following analysis assumes that the war is either co… For more info go to https://shorturl.at/aqrA6

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.