Natural Gas News – September 28, 2023

Natural Gas News – September 28, 2023

US NatGas Prices Edge Up 1% Ahead Of Weekly Storage

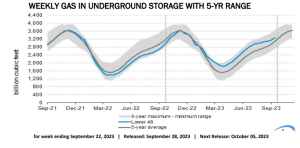

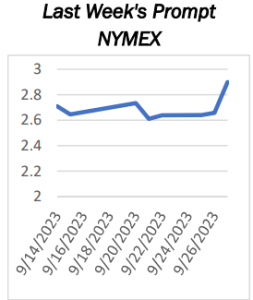

U.S. natural gas futures edged up about 1% to a nine-week high on Thursday on forecasts for more demand this week than previously expected. That increase came ahead of a federal storage report expected to show a near-normal build last week and forecasts for milder weather and less demand next week than previously expected. Analysts forecast U.S. utilities added 88 billion cubic feet (bcf) of gas into storage during the week ended Sept. 22. That compares with an increase of 103 bcf in the same week last year and a five-year (2018-2022) average increase of 84 bcf. If correct, last week’s increase would boost stockpiles to 3.357 trillion cubic feet (tcf), or 5.9% above the five-year average of 3.170 tcf for the time of year. On its first day as the front-month, gas futures for November delivery on the New

York… For more info go to https://shorturl.at/bhqKR

Joint Venture To Develop First LNG Ship Bunkering Hub

A joint venture is developing the first dedicated liquefied natural gas (LNG) bunkering facility for ships in the U.S. Gulf amid efforts by the maritime industry to find cleaner fuel solutions, executives said on Thursday. Shipping, which accounts for nearly 3% of global CO2 emissions and is under pressure from investors and environmental

groups to accelerate decarbonization, is exploring a number of other technologies including ammonia, methanol and wind in an effort to move away from dirtier bunker fuel. Sea path, a subsidiary of global business group Libra, and Houston-based energy infrastructure company Pilot LNG have formed a joint venture to develop, construct,

and operate the LNG bunkering facility in the greater Houston/Galveston area of Texas, with operations set to begin in early… For more info go to https://shorturl.at/gAFP3

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.