Natural Gas News – June 20, 2023

Natural Gas News – June 20, 2023

US NatGas Up 4% To Three-Month High With Hot Weather

U.S. natural gas futures gained about 4% to a three-month high on Friday on a recent drop in output and forecasts for demand to soar as the weather turns hot in late June, especially in Texas. Power use in Texas is expected to break records next week as homes and businesses crank up their air conditioners to escape the first heat wave of the 2023 summer season, the state’s power grid operator projected on Friday. That will boost the amount of gas burned by power generators, since Texas gets most of its power from gas. In 2022, about 49% of the state’s power came from gas-fired plants, with most of the rest from wind (22%), coal (16%), nuclear (8%) and solar (4%), according to federal energy data. In addition to preparing for the coming heat, utilities in Texas and other Gulf Coast states were restoring power to…

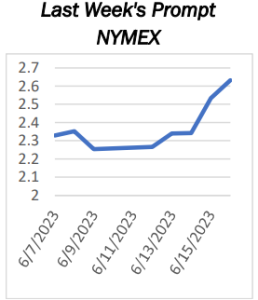

Here’s Why Natural Gas Futures Surged Last Week

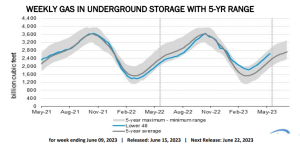

The U.S. Energy Department’s weekly inventory release showed a lower-than-expected increase in natural gas supplies. Following the positive inventory numbers, futures gained nearly 17% week over week to close at their highest since March. Other factors noted in last week’s spike are a hint of tightening supply and predictions of strong cooling demand. Despite all this, the market hasn’t been kind to natural gas in 2023, with the commodity trading considerably lower year to date and briefly breaking below the $2 threshold for the first time since 2020. At this time, we advise investors to focus on stocks like Chesapeake Energy CHK and Cheniere Energy LNG. Stockpiles held in underground storage in the lower 48 states rose 84 billion cubic feet (Bcf) for the week ended Jun 9, below the…

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.