Andy’s Supply Update: Growth in Global Oil Supply and Demand

As we progress through 2023, the petroleum industry is witnessing substantial shifts in demand and supply, with global oil demand growth surging and supply dynamics influenced by refinery maintenance and market responses to the surplus. More than ever, it is crucial to monitor these trends for a better understanding of the evolving market landscape. Just recently, OPEC announced plans to cut their output, which the team will cover in depth in tomorrow’s article. Here is what you need to know about the current state of global crude oil supply and demand for right now.

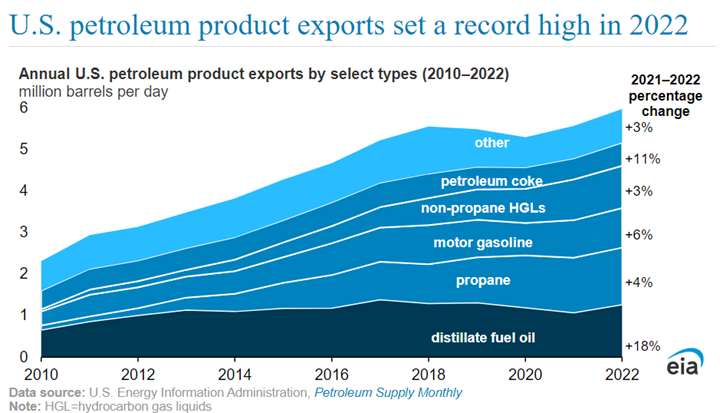

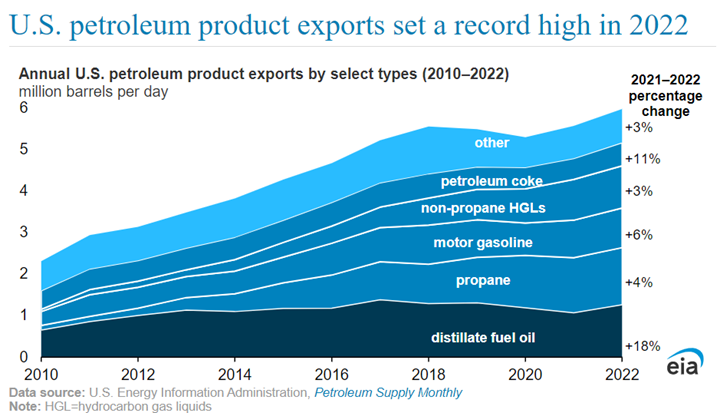

US petroleum exports have reached unprecedented levels, with 2022 marking the most exports in the nation’s history. The market set a new weekly record on March 17, exporting an impressive 11.94 million barrels per day (MMbpd). Diesel exports have been leading this growth, boasting an 18% year-over-year increase. Despite the boom in exports and refinery maintenance affecting the market, diesel supplies appear to be stable for now.

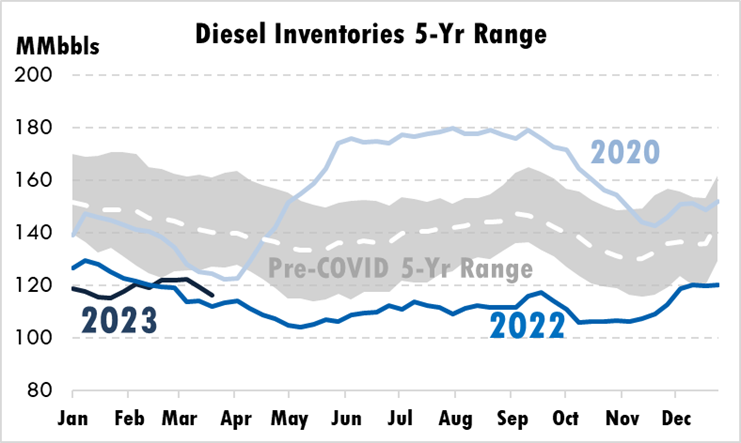

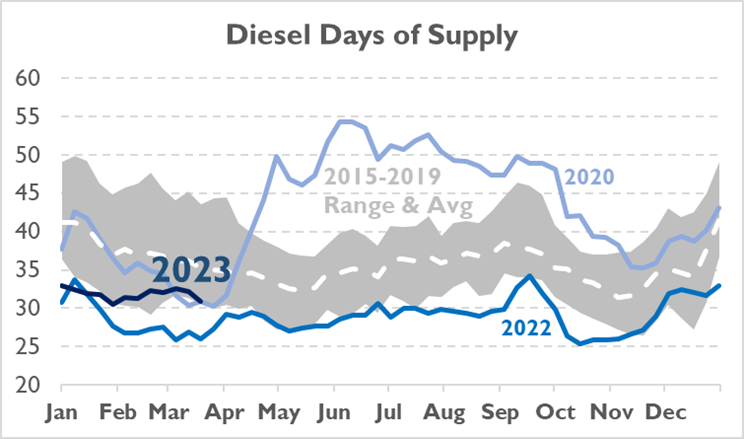

While diesel inventories are currently below their typical pre-COVID range, days of diesel supply have consistently remained above 30 days throughout the first quarter of 2023. This threshold appears to be the market’s comfort zone as long as the supply does not dip below the 30-day mark.

Following a decrease of 80,000 barrels per day (kb/d) in the fourth quarter of 2022, global oil demand growth is projected to rise significantly in 2023, increasing from 710 kb/d in Q1 to 2.6 million barrels per day (mb/d) in Q4. Average yearly growth is believed to have decreased from 2.3 mb/d in 2022 to 2 mb/d, with global oil demand reaching an all-time high of 102 mb/d. The resurgence of air traffic and the unleashing of China’s pent-up demand are major factors in the recovery.

In February, worldwide oil supply soared by 830 kb/d to 101.5 mb/d as the United States and Canada recovered significantly from winter storms and other disruptions. Non-OPEC+ countries are expected to contribute to global production growth of 1.6 mb/d this year, which will be sufficient to satisfy demand in the first half of 2023. However, it may fall short during the second half, when seasonal trends and China’s resurgence are projected to push demand to unprecedented levels.

High crack spreads in 2022 have led to delayed refinery maintenance, which is now impacting the petroleum market in 2023. Global refinery output reached a seasonal low in February, totaling 81.1 mb/d. This was due to the slow recovery in the United States combined with the initiation of planned seasonal maintenance in other regions. Despite the decline in middle distillate crack spreads, refining margins remain strong, particularly for those processing discounted Russian crude oil and feedstocks. In 2023, refinery runs are anticipated to average 82.1 mb/d, a year-over-year increase of 1.8 mb/d.

The crude market is grappling with an increasing supply that exceeds the still-muted demand, leading to stockpiles reaching 18-month highs. The majority of this supply surplus is due to the abundance of Russian oil being redirected to alternative destinations in light of EU embargoes and likely led to the recent OPEC+ production cut.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.