Banking Crisis, G7 Price Cap, and Record US Oil Exports Amid Economic Uncertainty – Navigating Turbulent Waters

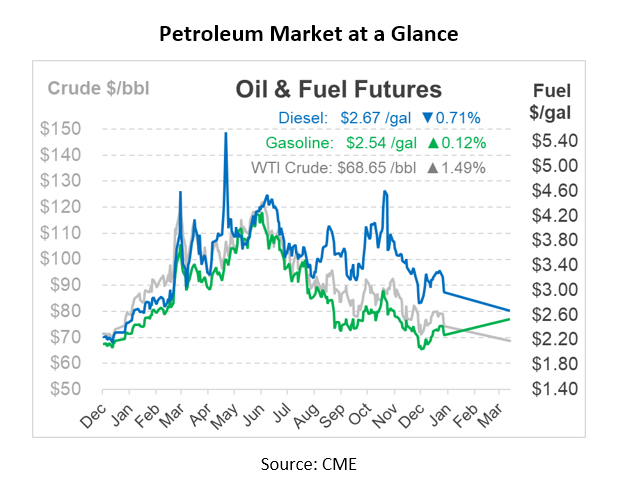

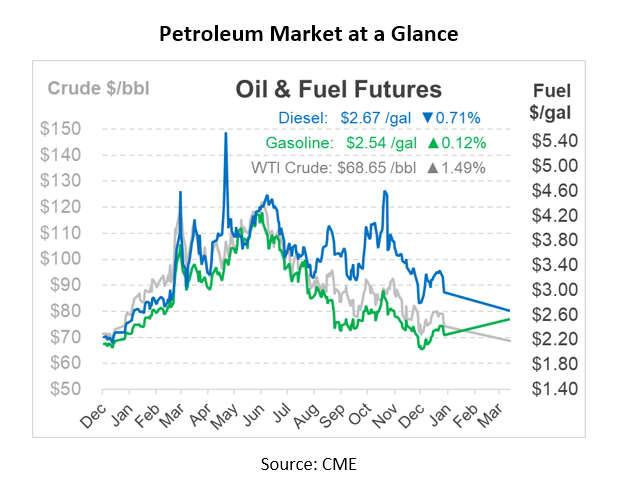

The ongoing banking crisis is significantly impacting crude oil prices, causing concerns among investors and traders worldwide. Last week, oil prices fell to the lowest level since a brief 4-day period in December 2021; prices have not been consistently below $70 since June 2021. This morning, oil was gaining buyers, which allowed the contract to return to $70/bbl on top of a weakening US dollar. Headlines continue driving volatility, with the market focused on issues ranging from the banking crisis and interest rates to new updates impacting global oil shipments.

Fuel prices are mixed, with diesel retreating while gasoline follows crude oil higher. At roughly 12.5cts, the diesel backwardation of the April and May contracts remains fairly large, suggesting markets feel good about long-term supply but lack confidence in the short-term. Continued energy strikes in France could be one of the potential causes of the difference in the short-term diesel price, according to trade sources.

U.S. oil exports reached an all-time high in 2022, reflecting the resilience and adaptability of the energy sector in the face of market challenges. In 2022, the United States achieved a new milestone for petroleum product exports, with a 7% increase from the previous year, as reported by the EIA. The daily average of US crude and fuel exports reached nearly 6 million barrels in 2022, led primarily by an 18% growth (193,000 b/d) in distillate fuel oil. Geopolitical disruptions in 2022 are expected to continue influencing global trade in crude oil and petroleum products throughout 2023.

The substantial volume of US petroleum product exports in 2022 also mirrored long-term growth patterns, with total petroleum product exports more than doubling from 2.31 million b/d in 2010. US motor gasoline exports grew in 2022, surpassing 2019 volumes and setting a new annual average record, with Mexico continuing to be the largest recipient.

Also, on the geopolitical front, G7 nations’ officials said yesterday that it’s doubtful they will adjust the Russian price cap this week. The $60/bbl price cap for Russian seaborne exports was initially set to be revised by the G7 nations in mid-March. According to Reuters, officials from the European Union claim that the G7 has “no hunger” for a quick assessment.

A pressing concern among investors and traders is whether the continuous interest rate increases by the Fed, which some attribute to causing the most significant banking sector collapse since the worldwide financial crisis, may finally cease. Authorities in the United States and Europe have consistently emphasized that the present unrest is distinct from the global financial crisis that occurred 15 years ago, citing improved capitalization in banks and more accessible funds.

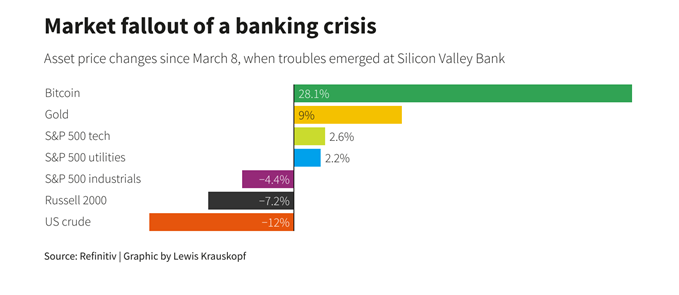

However, due to the abrupt impact, traders have heightened their expectations that the U.S. central bank might halt its rate-hiking cycle on Wednesday to maintain financial stability. Nevertheless, opinions remain divided on whether the Fed will indeed raise its primary policy rate. As you can see in the chart below from Refinitiv, crude oil prices have declined 12% since the banking crisis because of economic uncertainty and market speculation – outpacing losses in the stock market.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.