Sanctions, Production Cuts, and Inflation Concerns Cause Crude to Decline

Markets are weary this morning as traders examine the latest developments across the globe. Among the greatest concerns are sanctions and production cuts on Russian supply, Saudi Arabia spiking prices on its light crude, and the latest oil rig counts in the US and Canada that could predict how oil markets will perform.

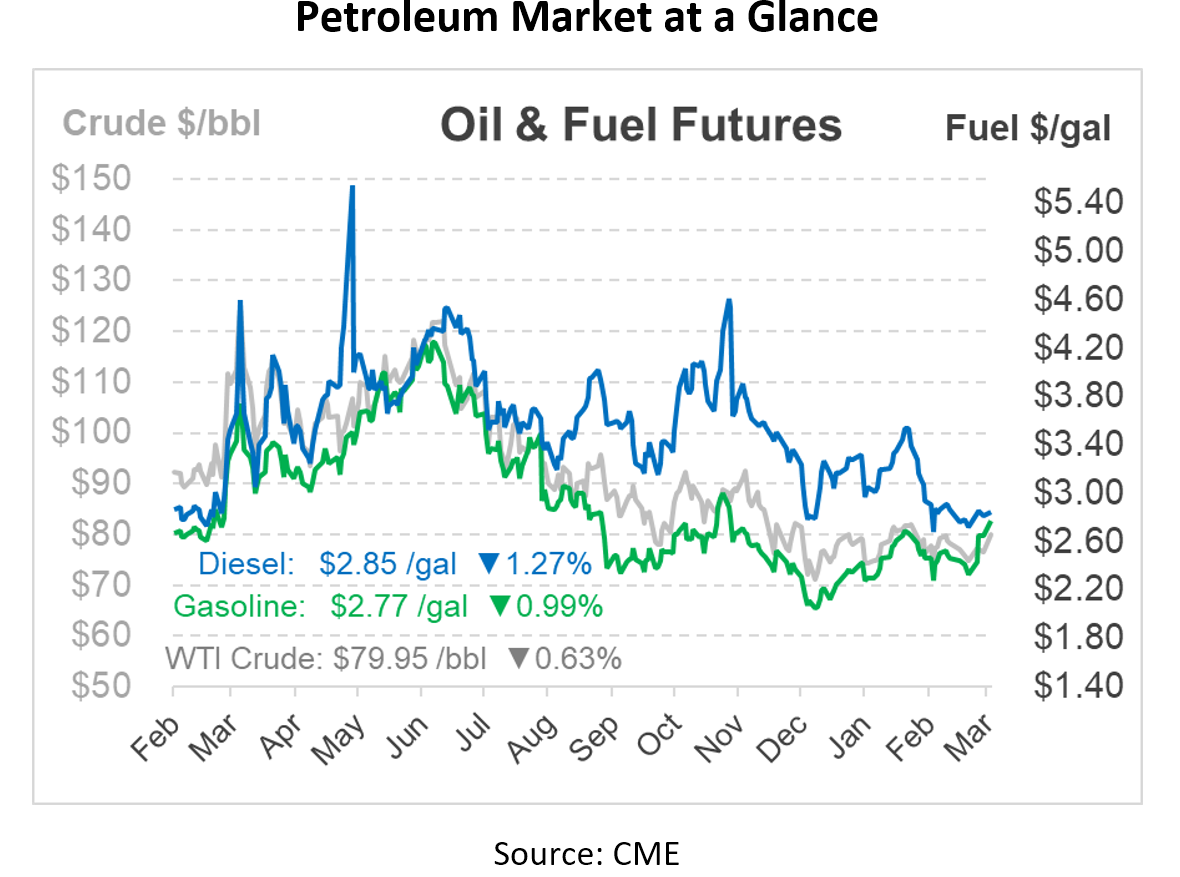

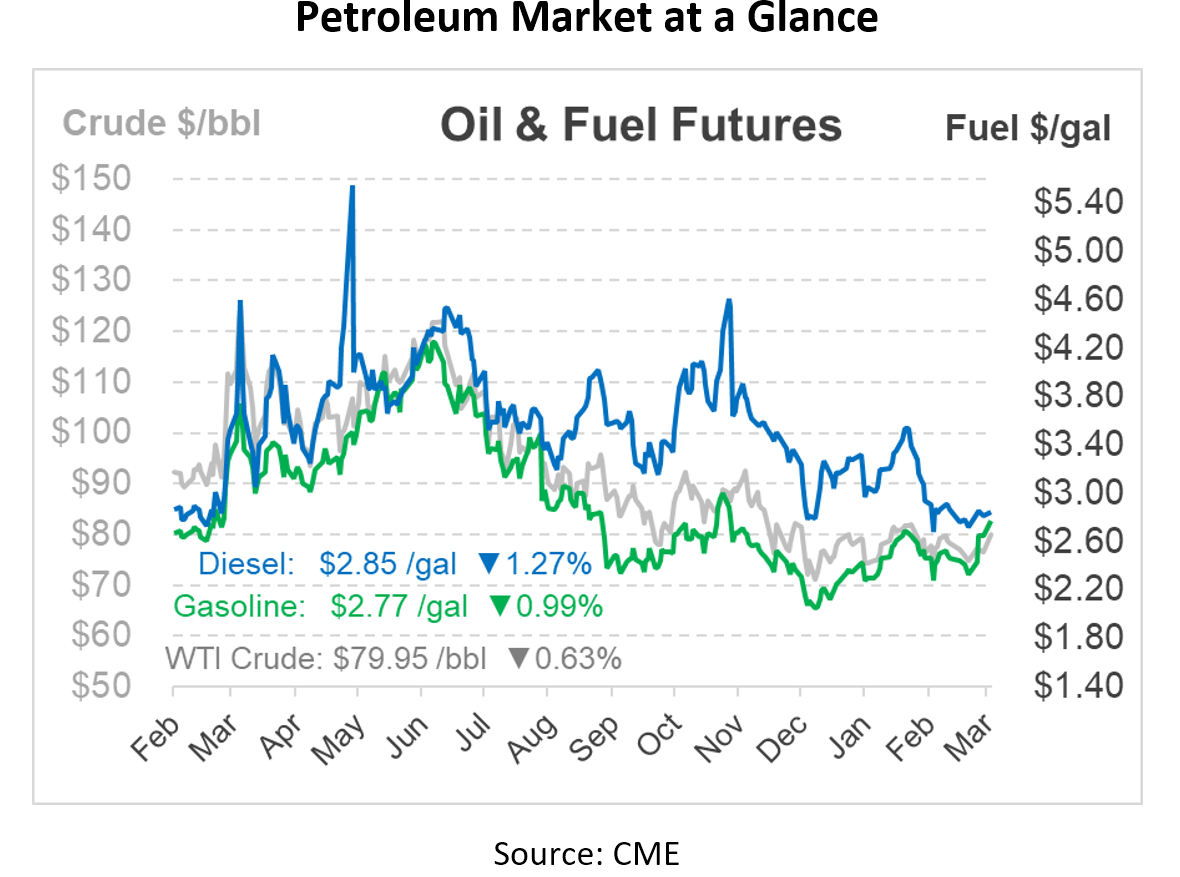

After steady gains, crude oil futures are down this morning. Prior to Fed Chair Powell’s address today, crude prices are still close to a five-week high despite the slight losses this morning. The market will eagerly monitor any signs of development for rate hikes. Powell is likely to allude to more hikes to combat sustained inflation that, though down from multi-decade highs, is still far above the central bank’s threshold.

BBG reported that the market is closely monitoring the impact of sanctions and production cuts on Russia’s supply. The latest data shows a 14% drop in Russia’s seaborne crude exports for last week. Additionally, European countries seeking to replace Russian barrels are facing insufficient crude supply from Kazakhstan. On the positive end, Europe’s diesel supplies are well above the 5-year average, suggesting there’s enough finished product to get through the foreseeable future.

Saudi Aramco has increased the prices of its Arab Light crude grade for Asian buyers for the second consecutive month. The latest price hike of 50 c/bbl indicates the company’s confidence in rising demand from Asia. The price to US customers remained unchanged, but there was an increase of up to $1.30/bbl for buyers in NW Europe and the Mediterranean.

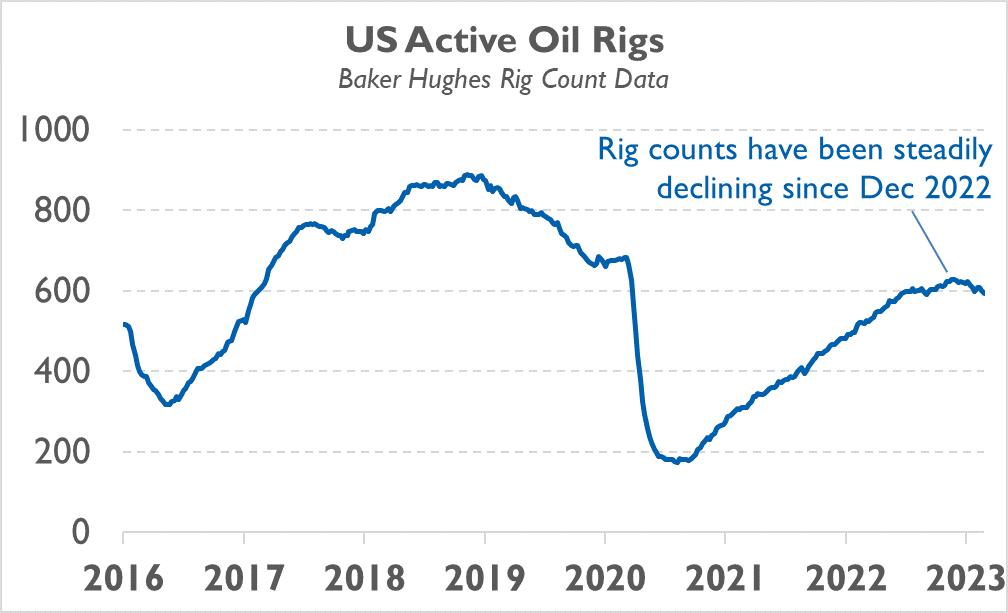

According to Baker Hughes Co.’s most recent oil rig count, the overall number of drilling rigs in operation in the United States has dropped below 750 for the first time since June. This number of operational rigs has not been seen since September. With 73 more oil rigs and 24 more gas rigs than during the week ending March 4, 2022, the total number of rigs is still greater than it was at this time last year.

A key metric of the trajectory of future oil and gas production is the number of active rigs. After plummeting during the demand disruption brought on by the pandemic, the number of operating rigs rebounded in 2021 and 2022. Rising rig numbers continued following Russia’s invasion of Ukraine on February 24 but plateaued at the end of 2022 as market momentum slowed.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.