NATURAL GAS NEWS – January 19, 2023

NATURAL GAS NEWS – January 19, 2023

EIA: Soaring Production Will Keep Natural Gas Prices

Continued increases in U.S. dry natural gas production are expected to outpace domestic demand and exports this year and in 2024 according to the EIA Continued increases in U.S. dry natural gas production are expected to outpace domestic demand and exports this year and next, sending the average U.S. benchmark price lower than in 2022, the U.S. Energy Information Administration (EIA) said on Wednesday. The EIA expects the U.S. benchmark Henry Hub price to average $4.90 per million British thermal units (MMBtu) this year, according to its January Short-Term Energy Outlook (STEO). The projected average would be more than $1.50/MMBtu lower compared to the 2022 average of natural gas prices. In 2024, Henry Hub prices are expected to remain almost the same compared to 2023 levels, as U.S. production is set to continue … For more info go to https://bit.ly/3iMPaQk

U.S. Natural Gas Demand Set To Climb As Cold Weather

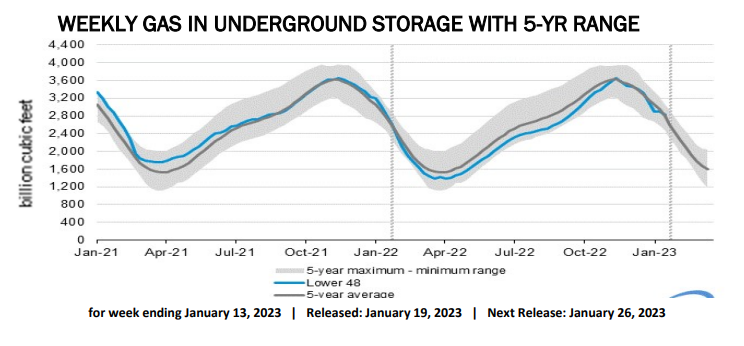

A forecast for a coming cold spell prompted a rise in the price of natural gas in the United States on Tuesday as it pointed to stronger demand for the commodity. On Wednesday morning, however, natural gas prices were falling once again as mild weather set in and storage levels remained above the five-year average. There will be some upward pressure on U.S. natural gas prices throughout the month as the cold spell is forecast for the final week of January. Even with a brief rebound, natural gas prices in the United States remain much lower than they were last year, when at one point they flirted with $10 per million British thermal units as U.S. LNG exports broke record after record to satisfy Europe’s demand for gas. On Tuesday, the first trading day for this week in the U.S., natural gas… For more info go to https://bit.ly/3JhNBF9

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.