The Week Ahead: Declining Futures and Debatable Production Forecasts

Analysis by Sydney Casey

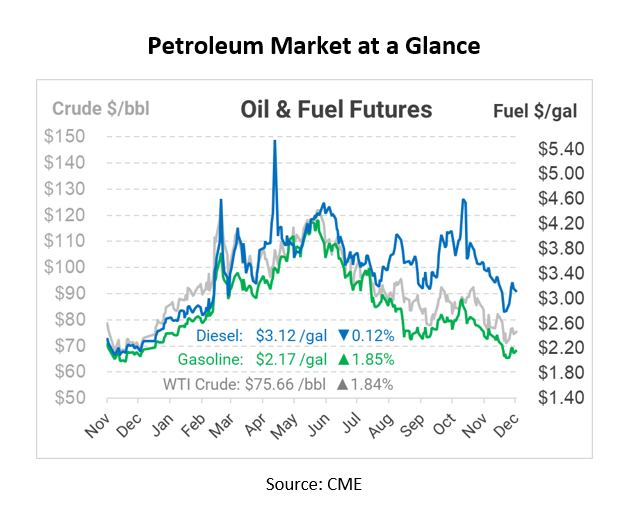

As we enter the holidays, you can expect futures trading to be sparse. Travelers could send a spike in gasoline demand, but as that slows into next week, we could see demand settle as potential winter weather threatens travel and demand. We’re in the middle of a cold snap throughout North America, expected to last at least a few more days. If that happens, we will likely see heating oil demand jump, adding pressure to prices.

The Biden administration announced on Friday that it would begin seeking bids to replenish 3 million bbl of the Strategic Petroleum Reserve beginning in February 2023. Although not a sizeable replacement, this purchase signals that the US is committed to replenishing the reserves. This comes at a stringent time as the SPR was recorded at its lowest level since 1984 at weeks end on Dec. 16. Moreover, the Department of Energy said it would exchange 1.8 million barrels from the reserve for Keystone-affected areas. Crude prices may see a floor near $60-$70 in 2023, since any lower prices will simply be bought up to refill the SPR.

US oil rig counts have fallen since October; however, the latest drop is noteworthy. For the second week in a row, the counts plummeted after hitting a high in November at 627. As of Dec. 16, 620 oil rigs were in operation – five fewer than the previous week. This is significant because the number of active rigs indicates the future trajectory of production.

Speaking of production, the EIA forecasts that US production will increase to an average of 12.34 million b/d in 2023, up from an average forecasted 11.87 million b/d for 2022. This is interesting as growing concerns of a recession linger. Some believe the recession has already begun and now question how long it will last and how impactful it will be.

Gasoline prices have kept their trend of tumbling prices over the last few weeks, officially dropping 54cts/gal lower than just one month ago. This morning, regular unleaded gasoline averaged $3.14/gal, while diesel averaged $4.76/gal, also significantly lower than last month. A myriad of factors could sway the market this week, such as China’s COVID policies, Russia’s new decision to attack Ukraine again, and US supply and production levels.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.