Week in Review – Dec 16, 2022

Analysis by Alan Apthorp

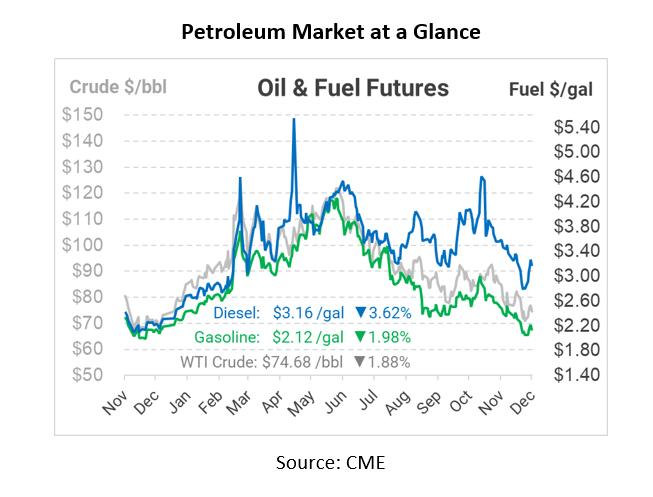

Fuel markets showed uneven trends this week, with crude oil rising early in the week and falling later. Diesel fuel, on the other hand, saw prices jump 50 cents from last week, before giving up almost 15 cents this morning. As always, volatility reigns supreme for the oil market.

US Interest Rates Rise

The Federal Reserve hiked interest rates by another .5% this week to a range of 4.25-4.50%, the highest since 2007. Although the hike was smaller than the past few hikes, it shows that the Federal Reserve remains aggressive in curbing inflation. Financial markets moved lower this week on the news since higher interest rates will slow down borrowing and spending.

Goldman Slashes Oil Forecast

Goldman Sachs, known to be one of the most bullish forecasting banks, reduced its Brent crude oil forecast from over $100 in the first half of 2023 down to the $90s. The bank expects the drop to be “transient,” however, with crude rebounding to $105 in 2024 thanks to high demand and chronic under-investment in oil production.

Fuel Inventories

Markets saw significant increases in fuel inventories this week, which added to bearish pressure. The EIA reported a 10-million-barrel build for crude stocks, a huge increase in a single week. Gasoline stocks also rose by 4.5 million barrels, putting them at the low end of the 5-yr range. Diesel saw a more moderate 1.4 MMbbl increase, leading to higher gains for diesel prices this week.

IEA Forecasts Record Demand in 2023

This week the International Energy Agency (IEA) released its monthly oil report, which showed global oil demand contracting in Q4. However, thanks to China re-opening its economy next year, the IEA is forecasting 101.6 million barrels per day (MMbpd) of demand in 2023 – a record high. Although economic activity may slow, oil demand may not feel the pinch, which could keep prices elevated next year. Supply next year is forecast to be just 100.8 MMbpd.

Keystone Pipeline Resumes Reduced Operations

The Keystone Pipeline, which was shut down due to a leak of roughly 600,000 gallons in Kansas, has resumed operations along some of the line. Although the affected segment remains offline, deliveries have resumed from Canada down to Illinois refiners. The pipeline re-starting is good news, though reduced flows down to Cushing, OK, could impact supply levels, causing higher prices for WTI crude (but not necessarily other crude indexes or fuel prices).

Prices in Review

Crude oil opened the week at $71.79. On Friday, prices were $76.37 – a gain of $4.58 (+6.4%). Much of those gains have been given up during Friday’s trading session.

Diesel saw the biggest gains this week, rising from $2.82 up to $3.28, a gain of 46 cents (+16.4%).

Gasoline prices entered the week at $2.06 and rose to $2.18 by Friday morning, a gain of 12 cents (+5.9%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.