Natural Gas News – October 11, 2022

Natural Gas News – October 11, 2022

LNG Freight Rates Hit Record High As Europe Races To Secure Gas

LNG carrier rates hit an all-time high on Tuesday, driven by growing prompt demand for gas in Europe as the continent tries to procure supply ahead of the winter. The freight rate to charter an LNG carrier in the Atlantic basin surged to $397,500 per day on Tuesday, according to Spark Commodities estimates cited by Bloomberg. The price to hire an LNG ship has now surged by 500% this year, as Europe is looking to import increased volumes of LNG to replace Russian pipeline gas, and north Asia is also preparing for the winter. The new record for Atlantic LNG freight rates was higher than the previous record of $374,000 per day set on Monday, as assessed by Spark Commodities. Europe’s demand has left few LNG ships available, and some buyers are now concerned they may not be able to charter vessels to bring in the gas… For more info go to https://bit.ly/3Mmm5FI

U.S. Natgas Futures Rise 2% on Higher Demand Forecasts

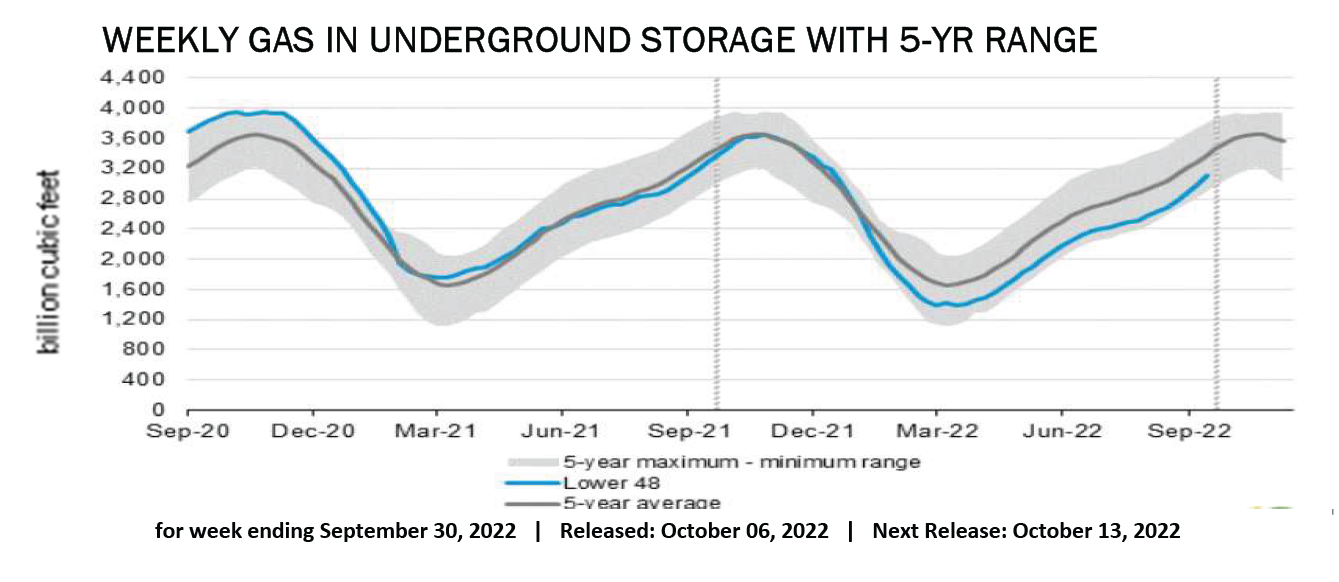

U.S. natural gas futures rose on Monday on forecasts for higher gas demand over the next two weeks despite record production levels. Front-month gas futures NGc1 rose 13.5 cents, or 2%, to $6.880 per million British thermal units (mmBtu) as of 9:23 a.m. EDT (1323 GMT). Data provider Refinitiv projected average U.S. gas demand, including exports, would rise from 90.1 billion cubic feet per day (bcfd) last week to 92.3 bcfd this week, and to 95.4 bcfd next week. “The market is pulled by forces from different directions and is trying to establish a new short-term equilibrium at the moment,” said Zhen Zhu, managing consultant at C.H. Guernsey and Co in Oklahoma City. “Higher prices have stimulated near-record production and we will continue to see increases in the production, which is likely … For more info go to https://bit.ly/3CjzutE

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.