East Coast Diesel Supply Shortages This Winter?

Earlier this year, the East Coast experienced incredibly severe diesel supply tightness caused by rising exports and steep market backwardation. Looking ahead, this winter could bring a resurgence of volatility for myriad reasons. Today, we’ll explore what might happen to diesel supply this winter.

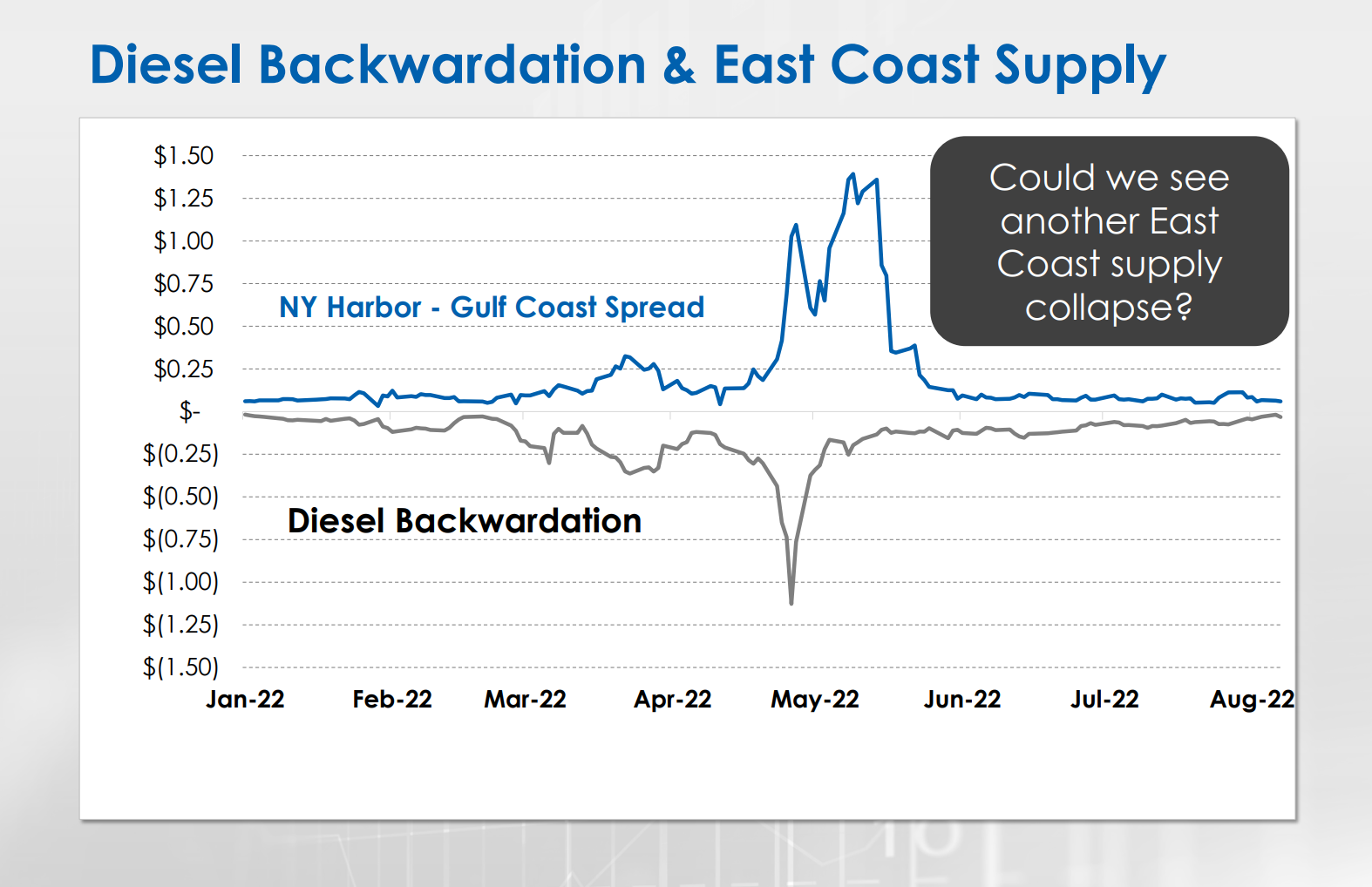

First, let’s recap what happened earlier this year. In April and May, the price of fuel in New York Harbor rocketed to more than a dollar above Gulf Coast prices (blue line in the chart below). This happened in part because the market was steeply backwardated. Backwardation relates to the futures market and suggests that traders expect prices to fall in the future. Traders in April, for example, expected May to be extremely tight, so they bid up May 2022 prices while June 2022 prices remained a dollar lower (grey line in the chart below). This steep volatility made pipeline shipments economically risky, so shippers stopped shipping product, resulting in shortages.

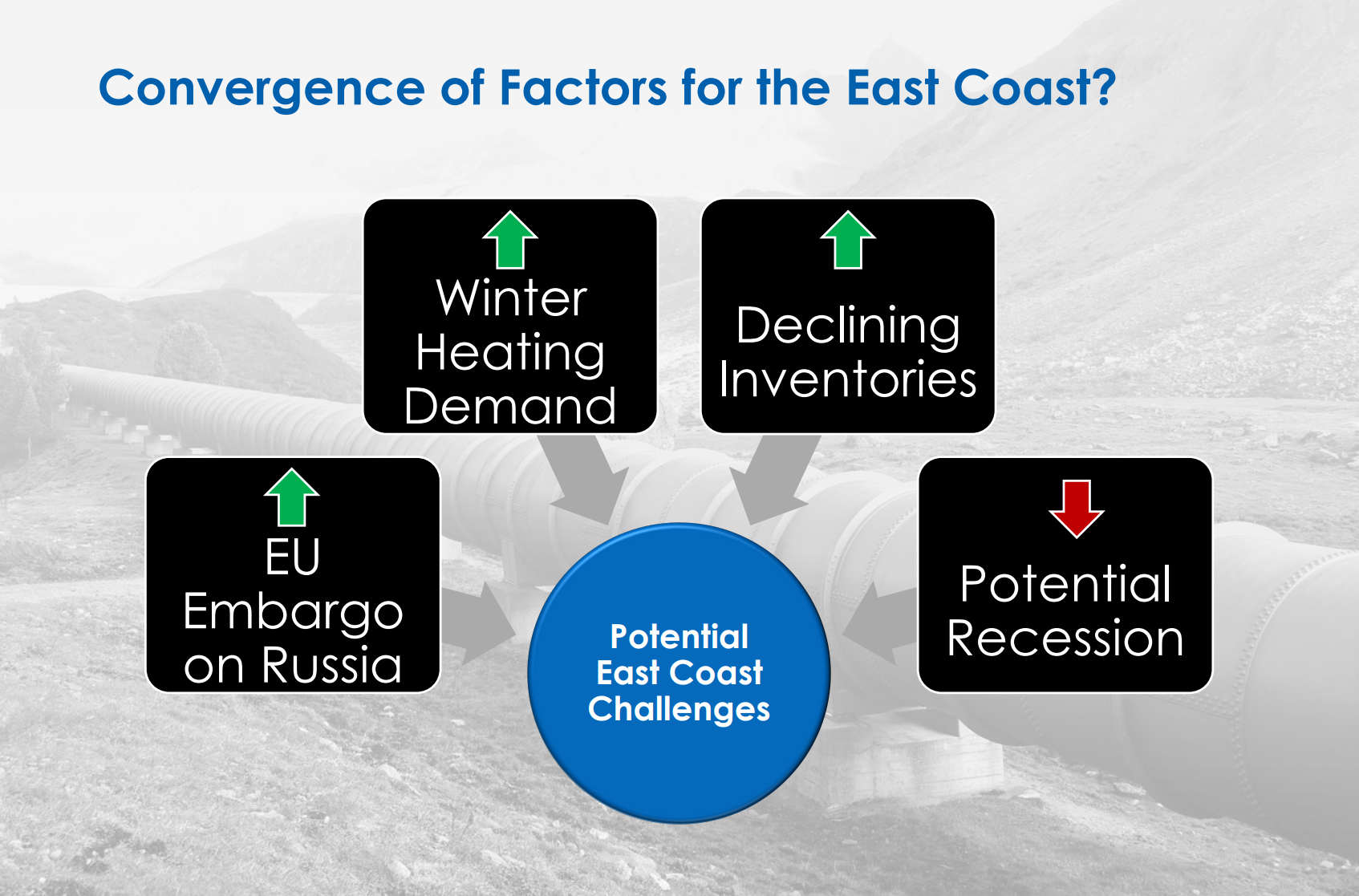

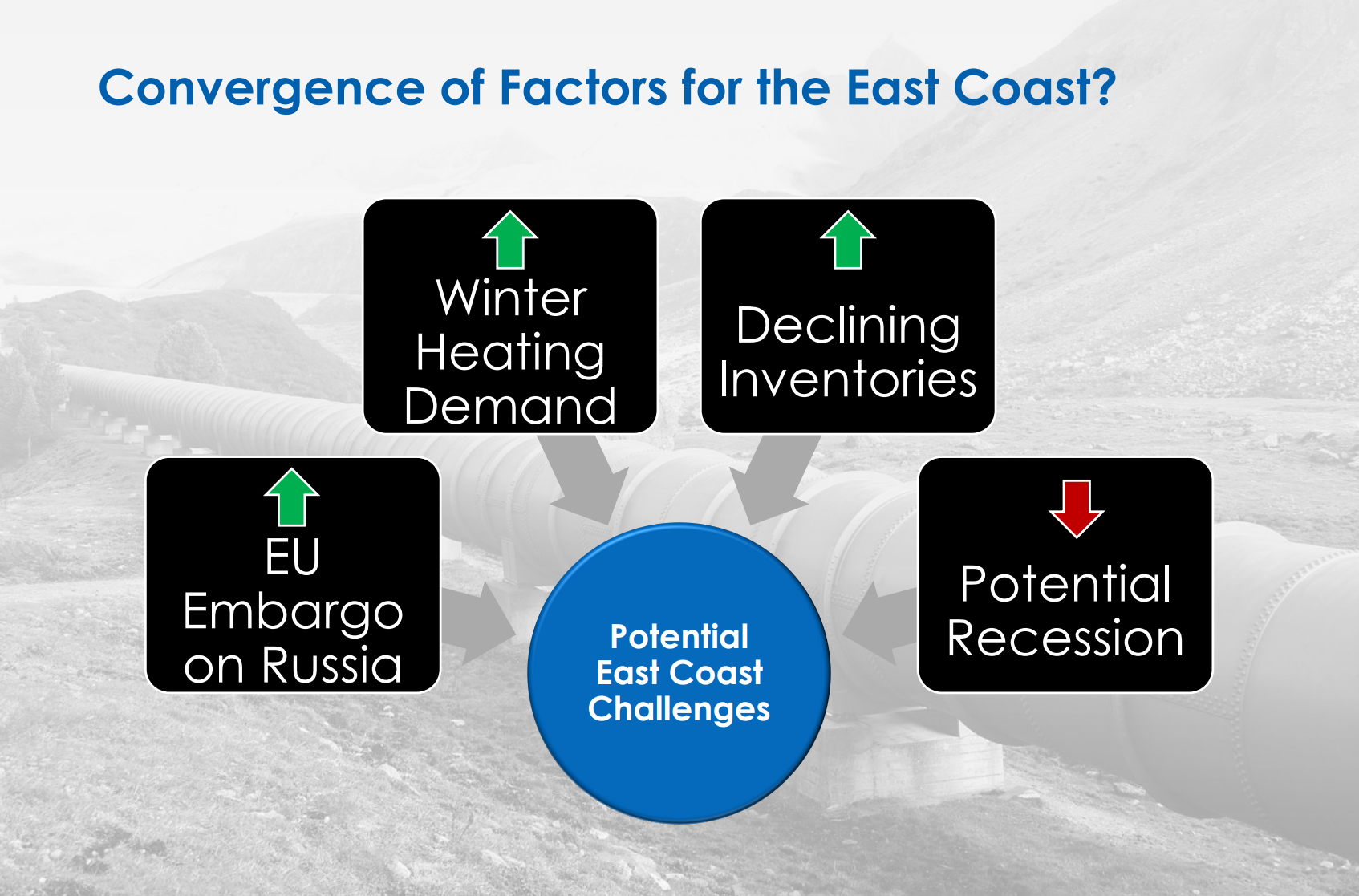

Looking ahead, a variety of factors could contribute to higher prices along the East Coast this winter. First, the EU’s embargo on Russian refined fuels goes into effect in February, so expect US exports to continue soaring. The winter also brings higher heating oil demand in the northern US and Europe, putting downward pressure on inventories. Finally, diesel inventories are already tight, exacerbating the supply situation. Of course, a potential recession is the looming counter factor, which could suppress demand and keep prices lower over the winter.

It appears the market is already pricing in a tight diesel market this winter. Although it’s difficult to evaluate future diesel prices given steep backwardation, one can look at the difference between diesel and gasoline prices. This winter, markets are expecting diesel to trade 70 cents above gasoline – nearly 20 cents higher than normal seasonal spreads. That 20-cent premium could end up even higher if hurricane season causes long-term outages, if winter is particularly cold, or if Europe’s transition from Russian oil doesn’t go smoothly.

The moral of the story? Be mindful of East Coast diesel supplies. It’s possible that we’ll see a normal winter with slightly elevated prices but no severe challenges. There is also potential, however, that a confluence of factors will cause tightness or even shortages for diesel consumers this winter.

As a final note, it’s worth exploring why these factors matter most along the East Coast. In part, since that’s the region most tied to European oil, it’s the one most linked to international events. The East Coast doesn’t have refineries, so it must compete with other countries to bring in fuel via pipeline or barge. The Midwest, which will also face a cold winter, gets much of its supply from Canadian crude oil blended at local refineries. The West Coast’s fuel infrastructure is separate from the rest of the country, producing enough to sustain itself and keep local markets in balance. The Gulf Coast is a fuel refining powerhouse, so there’s usually enough supply locally to cover demand.

While it’s possible that severe tightness could plague the entire US (and it’s worth noting that PADD 2 Midwest diesel stocks are well below the 5-yr average), the East Coast is the region most at risk of diesel supply shortages.

This article is part of Daily Market News & Insights

Tagged: Diesel Supply Shortages 2022, East Coast

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.