Week in Review – August 19, 2022

This week has been a mixed bag for oil markets, with no clear direction emerging during the week. The “will they, won’t they” of the Iran Nuclear Deal kept traders on their toes. A deal would allow roughly one million barrels of Iranian oil to reach global markets by the end of this year, before Europe’s embargo on Russia goes into effect. But both sides have objections to the deal. Iran wants a mechanism that will compensate them if the US unilaterally withdraws in the future, and the US has objected to removing its Revolutionary Guard from its list of terrorist organizations.

Early in the week, Chinese data revealed an economic slowdown for the world’s second-largest consuming nation. Their crude demand fell 9.7% year-over-year, sinking to the lowest since March 2020, and Chinese young people aged 16-24 face a record 19.9% unemployment. China’s central bank slashed interest rates to stimulate demand, a sign that their economy is struggling and needs stimulus. Other countries, particularly in Europe, are also showing signs of fragility. All this economic news has weighed on oil prices.

Although economic growth is weak, fuel demand remains strong – at least in the US. On Wednesday, the EIA reported the second highest weekly gasoline demand level of the year. It seems people in the US are still active and consuming as usual. Moreover, crude and gasoline inventories fell, a sign that supply is not keeping pace with high demand. If inventories keep sinking, we could see extremely tight fuel markets this winter, especially along the East Coast and Midwest regions.

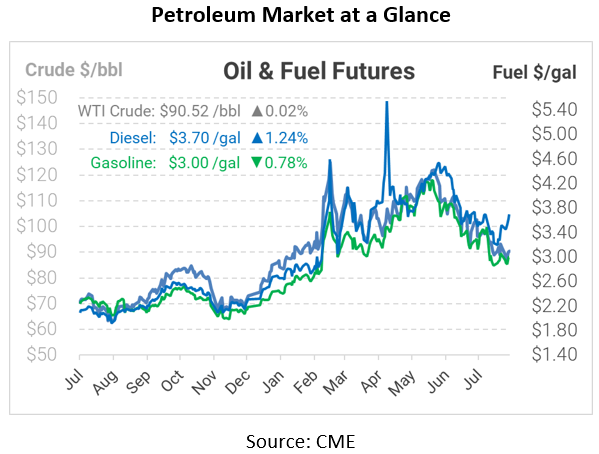

Prices in Review

Crude oil opened the week at $91.94, sinking lower as the week revealed poor economic results and improved hopes of an Iranian nuclear deal. The market bottomed out on Wednesday, moving higher Thursday after the EIA’s report showed tight markets. This morning, crude oil opened at $90.39, a small loss of $1.55 (-1.7%).

Diesel prices also began the week with a downward turn. Unlike crude, however, diesel’s rally began on Wednesday, leading to an increase in prices overall. Diesel opened the week at $3.51, and opened Friday morning at $3.6551 – a gain of 15.5 cents (+4.4%).

Gasoline prices saw some of the biggest moves during the week, falling from an opening price of $3.0593 to a low near $2.86 on Wednesday. However, the product rallied later in the week, opening Friday at $3.0296. That’s a loss of 3.0 cents, or -1.0%.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.