Week in Review – August 5, 2022

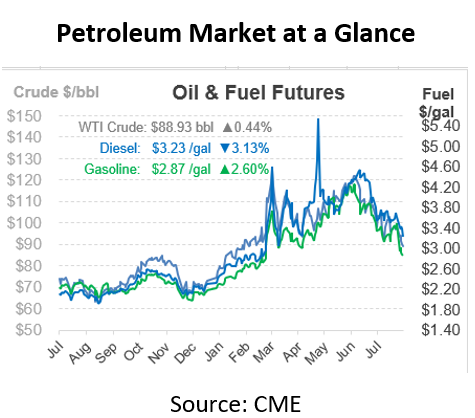

Yesterday, oil prices closed at $88.54, the first time WTI crude has dipped below $90/bbl since two weeks before Russia invaded Ukraine. Diesel is trading at its lowest point since April, while gasoline is at its lowest since late February.

Despite the spate of bullish factors on the supply side – a floundering US-Iran nuclear deal, Russian sanctions, and OPEC’s inability to increase output – the market cannot see past economic indicators that point to an impending (or current) recession. Gasoline demand falling below 2020 levels showed that consumers are behaving like they’re already in a recession, ignoring the debate between economists over whether current trends meet all the definitions of a recession. On the other hand, the US economy added half a million jobs in July, pushing unemployment to a post-pandemic low of 3.5%. That’s double the number of jobs that economists had expected for the month, adding more uncertainty to the question of a US recession.

A Reuters article yesterday argues that if we’re not in a recession already, the critically low level of diesel inventories will almost certainly plunge us into a recession. Diesel inventories are roughly 20 million barrels below 2008 levels when prices soared to a record high. Analyst John Kemp argues that the economy will need to slow down to reduce demand, or we’ll see astronomically higher diesel prices soon.

Prices in Review

Crude oil opened the week at $98.46 but sank lower on Monday to put prices below $95/bbl. Prices held steady for the next couple of days, but after the EIA showed a build in crude inventories, prices sank some more. The market continued tumbling on Thursday, bringing prices below $90/bbl. On Friday morning, WTI crude opened at $88.06, a loss of $10.40 (-10.6%) for the week and the lowest opening price in nearly six months.

Diesel prices didn’t see quite as much volatility during the week, but that’s more a result of a weak opening on Monday than any type of strength this week. Diesel prices opened the week at $3.54, down almost twenty cents from the prior week’s highs. Unlike crude oil, diesel actually gained on Wednesday when the EIA showed an inventory draw and extremely high exports. Despite the gain, prices tumbled along with the rest of the market on Thursday and Friday. Diesel opened on Friday at $3.29, a loss of 25 cents (-7%).

Gasoline largely echoed crude oil this week, with prices sinking to levels not seen since late February. On Friday, the August crude oil contract expired at $3.49; on Monday, the September contract picked up at just $3.11. By the end of Monday, prices had fallen below $3/gal. A brief rally on Tuesday brought prices higher, but declining demand sent prices plummeting once again on Wednesday. The decline continued Thursday, leaving gasoline with an opening price down 34 cents (-11.1%) at $2.7636.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, Daily Market News & Insights, oil prices, Supply, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.