Is Gasoline Demand Really Falling?

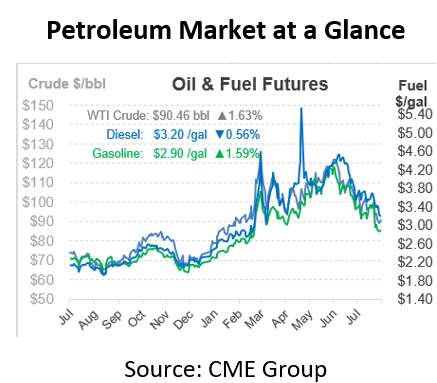

There’s no question that the economies worldwide face a looming recession. Countries in Europe appear particularly at risk, with severe contractions expected for countries like the UK, Germany, and France. The US has seen GDP fall for two quarters, but a number of indicators point to resilient economic activity. One factor, gasoline demand, has seemingly pointed to a sharp contraction, with the EIA showing demand levels below pandemic levels in 2020. Is the data correct?

A recent Bloomberg article suggests that the EIA’s data could be incorrect. For starters, the EIA measures the amount of product leaving refiners and product terminals, not necessarily how much fuel is actually purchased by consumers. GasBuddy data suggests that purchases are high, with their data suggesting demand is closer to 9.5 MMbpd (versus 8.5 MMbpd in the EIA data). Moreover, ethanol blending has held steady. Typically, ethanol is blended with gasoline for a 10% blend rate. If gasoline demand is falling, ethanol blending should also be falling.

The EIA’s weekly data is an estimate based on surveys with industry players to get a general assessment of market activity. Its monthly report, which for July’s data will be published in September, is more authoritative and accurate. That means it could be a while before we get definitive answers on gasoline demand. In the meantime, take the gasoline demand data with a grain of salt – the outlook for US fuel markets may not be as bleak as it seems.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, gasoline, oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.