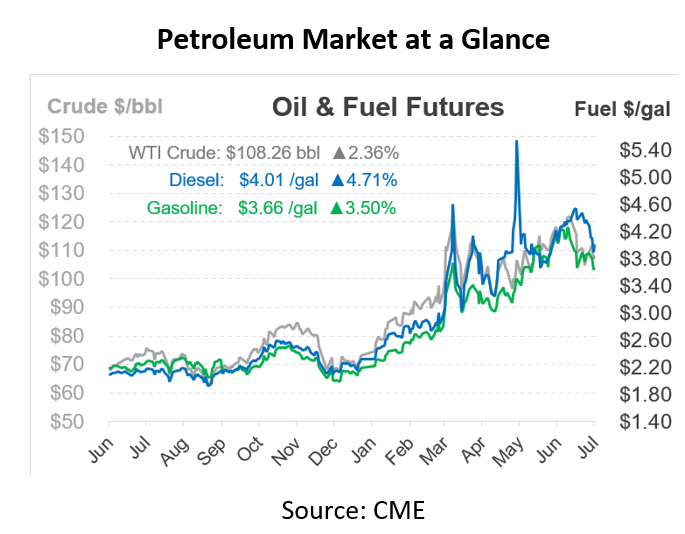

Week in Review – July 1, 2022

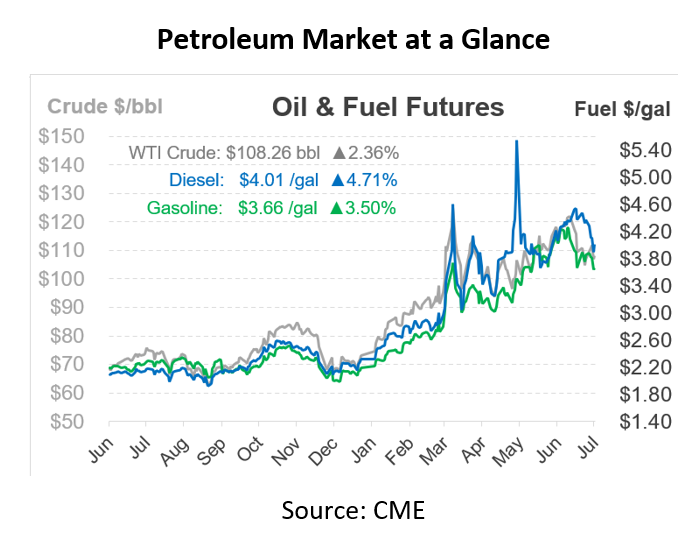

Heading into the holiday weekend, fuel prices are springing higher, though not fully offsetting losses seen earlier this week. This week has been filled with volatility, with gasoline shedding 20 cents from Monday’s close while diesel fell by 30 cents. Today’s ten-cent gains undo some of those declines, but overall the week has moved in a direction more beneficial for fuel buyers.

Midweek losses were largely attributable to hefty declines in US fuel demand, a possible leading indicator of an economic downturn. With prices near historic highs, consumers seem to be slowing their purchases – so travel stats from this holiday weekend will be an important data consideration. AAA is projecting 47.9 million drivers hitting the road this weekend – 3.7% above last year but not quite back to 2019 levels. If actual travel data underperforms, it could be a sign that consumers really are averse to higher fuel costs.

Adding to downward pressure, OPEC+ agreed to lift production quotas for August. The group of oil producers agreed in 2020 to restrict their supply by 9.7 million barrels per day; since then, they have been slowly unwinding that production agreement. August’s hike will officially be the last increase. The deal signed in 2020 expires at the end of September 2022; so far, OPEC+ has not commented on whether it will require countries to follow the deal through September or if it will allow countries to pump at will.

On the flip side, there’s plenty of news supporting prices also. Libya and Ecuador both announced sharp reductions in their output due to political unrest and protests. Together, those two producers have the capacity to produce 1.8 million barrels per day – almost 2% of global oil supplies. With both countries suffering severe outages, supplies will remain thin. Moreover, despite OPEC+ agreeing to production hikes on paper, many question whether the group can actually hit their targets. Many countries have struggled to ramp up output, so the end of the deal may not mean much for markets.

Prices in Review

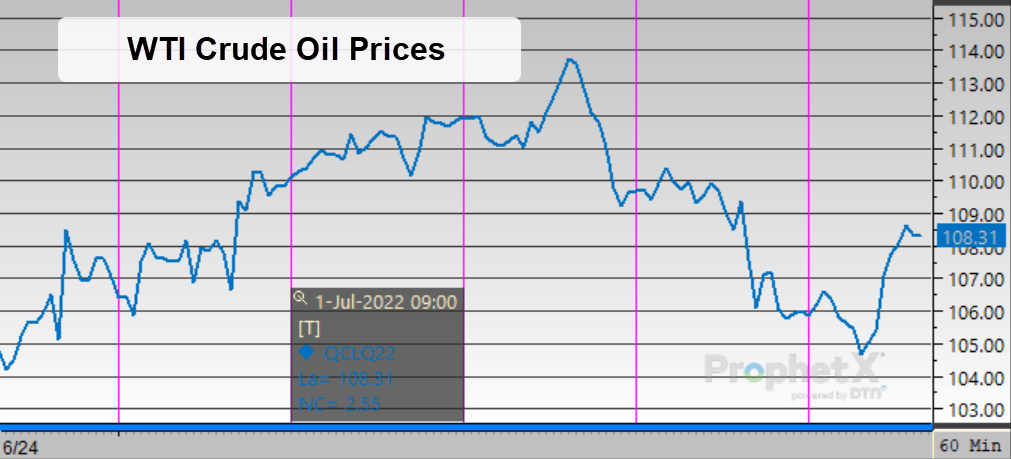

WTI crude oil prices looked like a roller coaster this week, with a big build-up leading to a sell-off later in the week. Opening Monday at $107/bbl, prices climbed to a peak near $114 – a 6.5% climb over two days. Those gains were wiped out on Wednesday and Thursday after the EIA’s oil report, with prices going as low as $105. Since then, the market has rebounded a bit, with Friday seeing prices near or slightly above Monday’s opening rate.

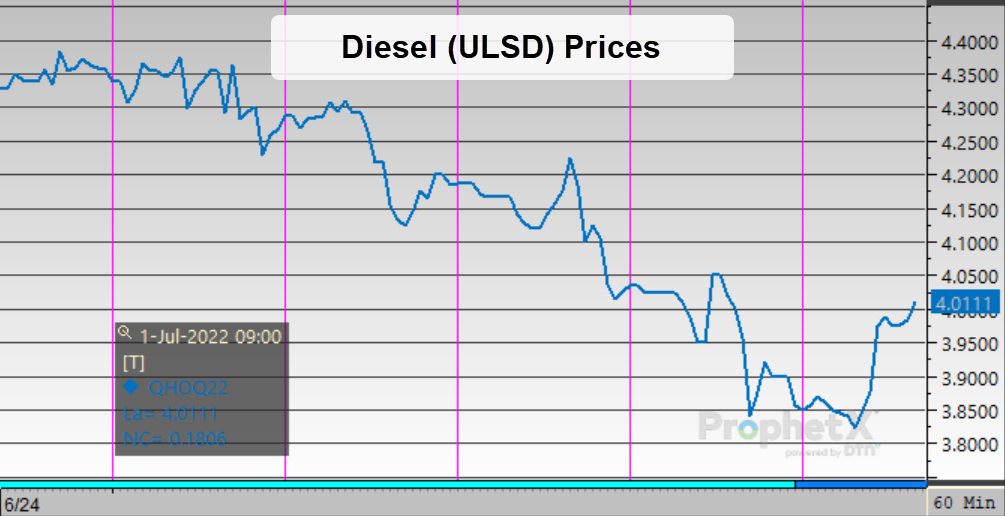

Unlike crude oil, diesel prices showed a clear downtrend throughout the week. The middle distillate contract opened the week at a lofty $4.35, but fell steadily each day as the API and EIA each noted rising inventories and falling demand. On Thursday, the product closed just below $3.90 – more than 10% below it’s Monday price. This morning, however, prices are springing higher, bringing the contract back above the $4/gal mark.

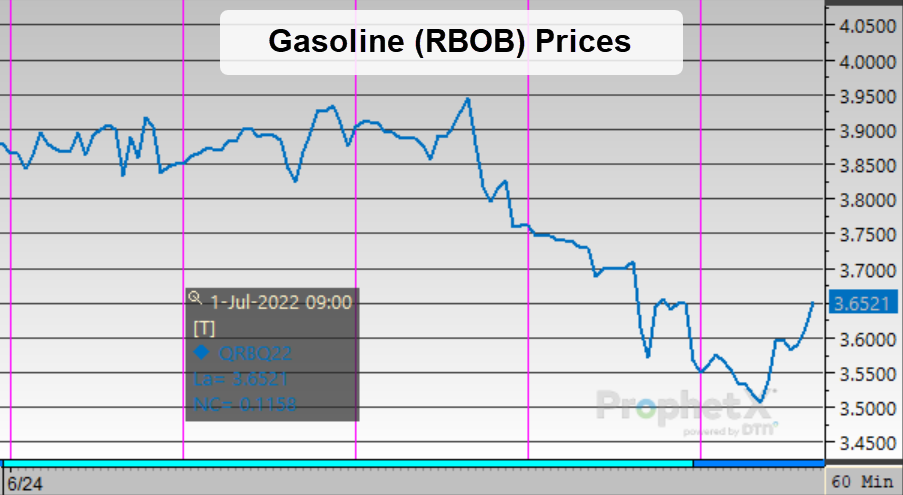

Finally, gasoline’s behavior appears to be halfway between crude and diesel. Crude oil shot higher earlier this week and diesel fell, but gasoline traded sideways for the first few days of the week. Opening at $3.87, the RBOB contract rose a bit to hit a high of $3.95 for the week, but eventually fell much lower. On Thursday, gasoline closed at $3.65, a 22-cent (-5.7%) loss. This morning, unlike other energy products, gasoline is only treading water, trading in line with Thursday’s closing price.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.