Citi: Recession Could Cause Oil to Fall 40%

After a long trading holiday for US markets over the July 4 weekend, prices are trading sharply lower as traders continue pricing in the risk of an economic recession. Also contributing to the downward market is the return of 450+ thousand barrels per day (nearly 0.5% of global supplies) from Ecuador, where protests have ended and normal fuel operations have resumed. Of course, challenges remain – Norway expects reduced supply due to a worker strike. Overall, the focus is squarely on the economy, and a new Citi report explains the risks.

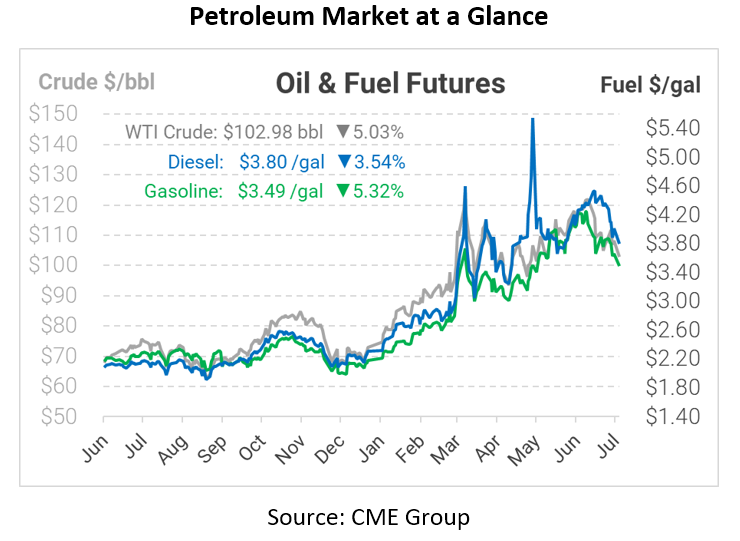

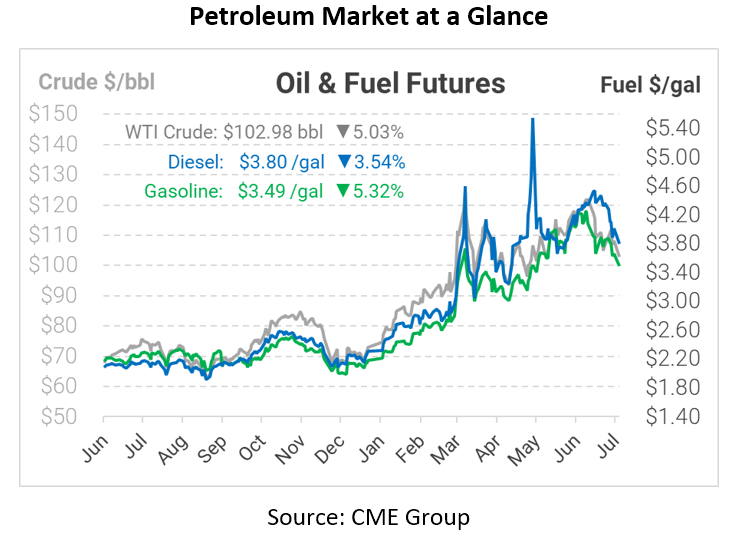

Citi recently released a report noting that crude oil could fall to $65/bbl by the end of 2022 if a severe recession hits, plummeting further to $45 by the end of 2023 if the recession is prolonged. This represents a 40% reduction from current levels, implying fuel prices falling by roughly $1/gal. Although the bank is not forecasting a recession this year, they are carefully watching interest rate hikes and their impact on economic activity. Following significant fuel price spikes like those seen in the 1970s or 2007-2008, recessions can slash demand and push prices sharply lower. The bank added that oil demand turns negative in only the most severe scenarios. Still, even slowing demand growth would tip the markets and send prices crashing back to the “marginal cost,” referring to the crude oil price needed to incentivize just enough oil production to cover demand.

Adding further pressure, the US Dollar Index is at a 20-year high. The index measures the US Dollar against a basket of other currencies from Canada, Japan, and Europe, with the 1973 value set as 100. The US Dollar is considered a safe haven investment, and rising interest rates in the US means there are more low-risk investment opportunities (such as bonds) in the US than in other countries. Since oil markets worldwide are priced in dollars, a rising USD makes crude oil more expensive for other countries since they must use more of their local currency to buy the same quantity of oil. The one-two punch of recession fears causing a flight to the dollar and rising costs for non-US traders is weighing heavily on prices.

This article is part of Daily Market News & Insights

Tagged: Citi, crude oil, July 4, oil, oil prices, Oil production, US Dollar Index i, US markets

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.