Natural Gas News – June 1, 2022

Natural Gas News – June 1, 2022

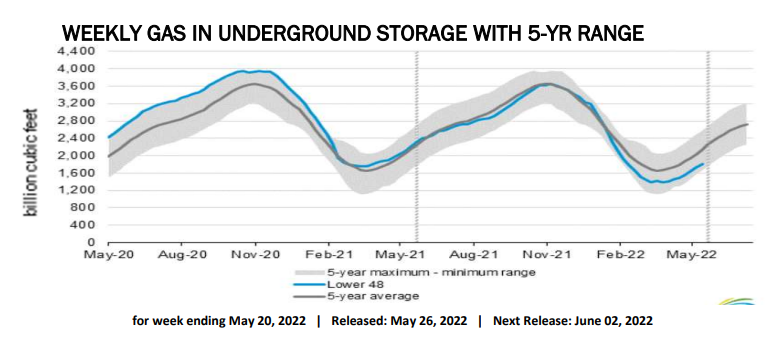

Price of Natural Gas Could Climb Higher

Summer heatwaves could also push prices higher by driving up electricity demand. Natural gas prices could climb even higher, especially if hot weather boosts demand this summer. The rising price of oil may grab most of the headlines, but another commodity — natural gas — is on an even wilder ride and expected to hit fresh highs this summer. The war in Ukraine and resulting concerns about global energy security have driven up commodity prices worldwide. But where the price of oil is up about 85 percent year-over-year, natural gas is up more than 200 percent. Natural gas, rare earth minerals: What’s at stake for Ukraine in the territory Russia is trying to conquer. U.K. introduces a temporary ‘windfall tax’ of 25% on oil and gas profits. For more info go to https://bit.ly/3NFCCUA

Analysts Say Natural Gas Could Go Even Higher

The rising price of oil may grab most of the headlines, but another commodity — natural gas — is on an even wilder ride and expected to hit fresh heights this summer. The war in Ukraine and resulting concerns about global energy security have driven up commodity prices worldwide. But where the price of oil is up about 85 percent year-over-year, natural gas is up more than 200 percent. As of mid-day Friday, the U.S. natural gas benchmark Henry Hub price was trading around US$8.75 per million British thermal units, or MMBtu. It surged to a 14-year high of more than $9 earlier in the week, from less than $3 at this time last year. “It’s like if oil went to $200 (per barrel), but it’s not getting the same kind of attention,” said Dulles Wang, a Wood Mackenzie analyst based in Calgary. For more info go to https://bit.ly/3LXpN72

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.