EU Bans Russian Crude Imports – Oil Spikes to 2-Month High

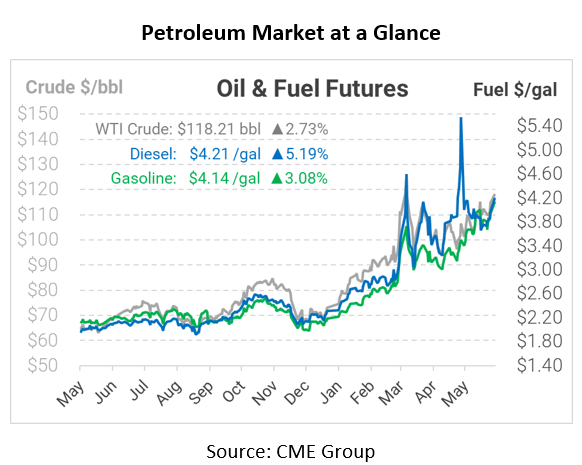

After weeks of negotiations and discussions, the EU has formally announced a ban on Russian oil. The agreement, reached on Monday, will see 90% of Russian crude banned by the end of this year. With this new ban, oil prices this week have been on the rise, reaching highs not seen since early March.

The ban will halt the import of all seaborne oil purchases, which account for roughly 60% of Russian oil exports to Europe. Pipeline shipments were excluded from the ban. Poland and Germany, which currently import via pipeline, also pledged to end purchases, covering an additional 30% of Russian oil imports. The southern line of the Druzhba Pipeline represents the remaining 10-11% that will remain online, providing oil to Hungary, Czech Republic, and Slovakia. Some 60% of Hungary’s oil is supplied by the pipeline, so a complete ban was deemed to have been too detrimental to the country’s energy security. Many have spoken out about the potential of major supply issues coming from such a ban, but the EU has made it clear they have security measures in place that would send emergency supply to member states if the worst were to happen.

It’s worth noting that the demand allows the remainder of the year – seven months – for countries to comply with the measure. In the short term, EU companies can continue buying Russian oil, and it’s unclear how countries will choose to phase out those purchases. With around 36% of oil imports to the EU coming from Russia, it will certainly shake up an already tight market in the months to come. With this new ban accompanying an unwilling OPEC+, prices are expected to stay high for the foreseeable future. Over the next sixth months, sanctions on Russian crude will be strategically phased. Along with the crude phase, countries must stop refined product imports within eight months.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.