Russian Oil Is Still Flowing – What an EU Ban Could Mean for Fuel Prices

There’s been a lot of confusion lately about Russian oil production. On one hand, the US and the UK banned imports of Russian oil, and the EU keeps talking about their own ban. On the other hand, these bans have been less restrictive than, say, the sanctions against Iran and Venezuela. Countries outside the Western world continue buying Russian oil, and even Europe is still buying millions of barrels each day from the Kremlin. So what’s really happening to Russian oil right now?

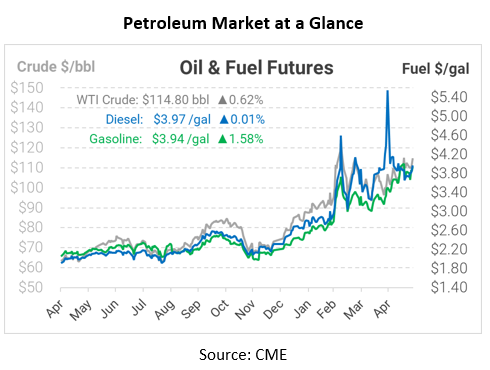

Since Russia’s oil companies are primarily state-owned, the data they release is not necessarily reliable. According to a recent report from Bank of America, Russia’s oil production has fallen just 1 million barrels per day from their 11.4 MMbpd pre-invasion level. Earlier in the crisis, traders significantly cut back on buying Russian oil, but the stigma seems to have cooled for all but the largest trading companies. Based on current trends, BofA expects production to continue falling to 10 MMbpd next year. The bank is currently forecasting a $120/bbl price for Brent crude this year, but that could rise to $150 if the EU follows through on its ban. That $30/bbl increase translates to a 70 cent per gallon increase for fuel – not counting further increases in diesel and gasoline premiums on top of high crude prices.

Why has Russian oil production not fallen more? One must look to the Eastern Hemisphere for an answer. Russia’s crude oil tanker exports have more than doubled as pipeline shipments have decreased, with much of the excess oil going to India and China. With oil prices at high premiums, some countries are putting economics before politics to keep their fuel prices lower. The trend is expected to continue, with more seaborne crude moving east. Of course, China and India only have so much capacity to absorb additional Russian oil; for an in-depth analysis of Russia’s export capacity to China and India, click here. Once the EU cuts off Russian oil, there will be few new places for that oil to go, and we could see dramatically higher fuel prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.