American Inflation: Are High Prices Here to Stay?

Despite comments from the Federal Reserve last year that inflation is merely transitory and short-lived, many experts are increasingly expecting that inflation in the United States will be a prolonged problem for many years to come. With commodity market prices skyrocketing and no immediate relief in sight for consumers, the question remains – will inflation stay, or will it go?

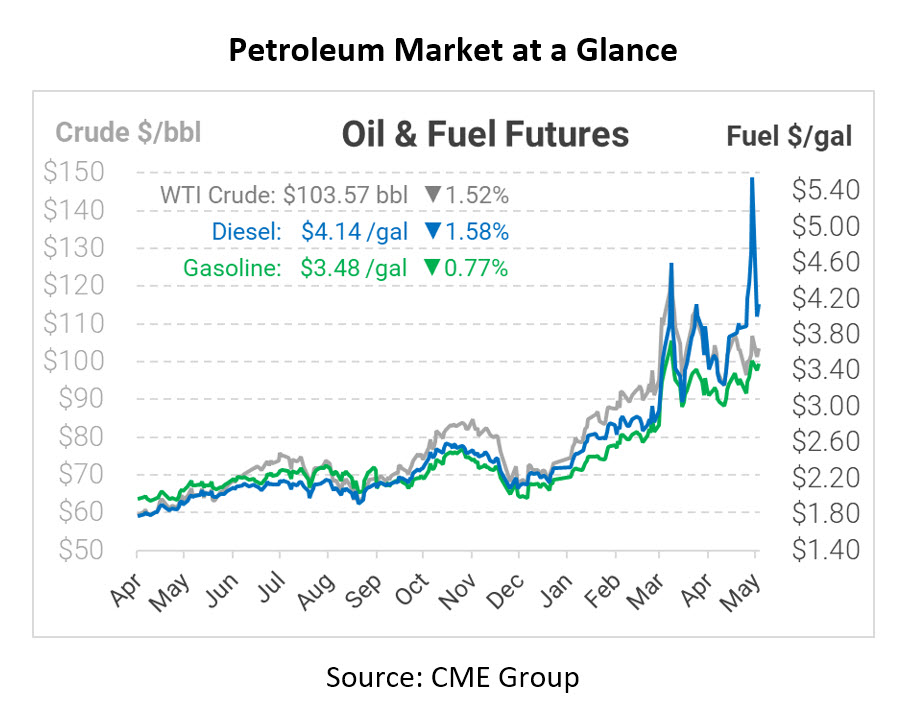

It is no surprise that rising prices have impacted Americans across all industries in the past year. From buying your next carton of milk at the supermarket to filling up your car with gasoline, prices continue to rise. For example, in the past 12 months, gasoline is up 48%, natural gas is up 21.6%, meats/poultry/fish/eggs is up 13.7%, and the list goes on. Now, Moody’s Analytics Chief Economist Mark Zandi believes that inflation is becoming a self-fulfilling prophecy. As more people expect prices to rise in the future, they stock up on goods now, stoking demand and driving prices even higher.

Although global events have shaken up the supply change in the last few months and driven prices far above normal inflation rates, it is clear that inflation is not improving, and the once told narrative of it being “transitionary” is becoming dimmer. Last year, the President, advisors, and the U.S. Treasury Secretary told Americans that this inflationary period is just temporary and there was nothing to worry about.

Inflation makes life more challenging for businesses and more frustrating for consumers. Regardless of how tumultuous this situation may seem, there are some actions that can stem the flow of inflation. The Fed is planning to fight inflation with some of the fastest rate hikes in decades – aiming for at least 2.4% interest rates by the end of the year. If this historical pace is kept, the government may be able to fight inflation by making it more costly to borrow. Of course, there are risks, including a possible economic recession if the Fed cannot achieve a so-called “soft landing.” There are many moving pieces, and for consumers, this could mean a rapid halt in spending. For fuel, rising interest rates are typically bearish, though inflation and other forces driving fuel higher may remain strong enough to counteract Fed rate hikes.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.