Natural Gas News – April 1, 2022

Natural Gas News – April 1, 2022

What Is Holding U.S. Oil Production Back?

The U.S. energy sector continues to be an outlier in this bear market, gaining +6.6% last week thanks to riding a rally in crude prices after Yemen’s Houthi rebels claimed a series of attacks on Saudi Aramco oil storage facilities. May Brent crude (CO1:COM) settled +12% at $120.65/bbl while May WTI crude (CL1:COM) closed +10.5% for the week at $113.90/bbl. The attacks have come at a time when supply risk is higher than it has been in years, with Price Futures Group’s Phil Flynn telling MarketWatch the supply-demand deficit is only going to get worse. Meanwhile, U.S. natural gas (NG1:COM) soared 15% for the week to $5.571/MMBtu, boosted by bullish sentiment from the news that the U.S. will increase shipments of LNG to Europe in an effort to lower the continent’s dependency on Russian gas. With the oil and gas market… For more info go to https://bit.ly/3tTuAR2

U.S. natgas rises 5% to near 9-week high on soaring global…

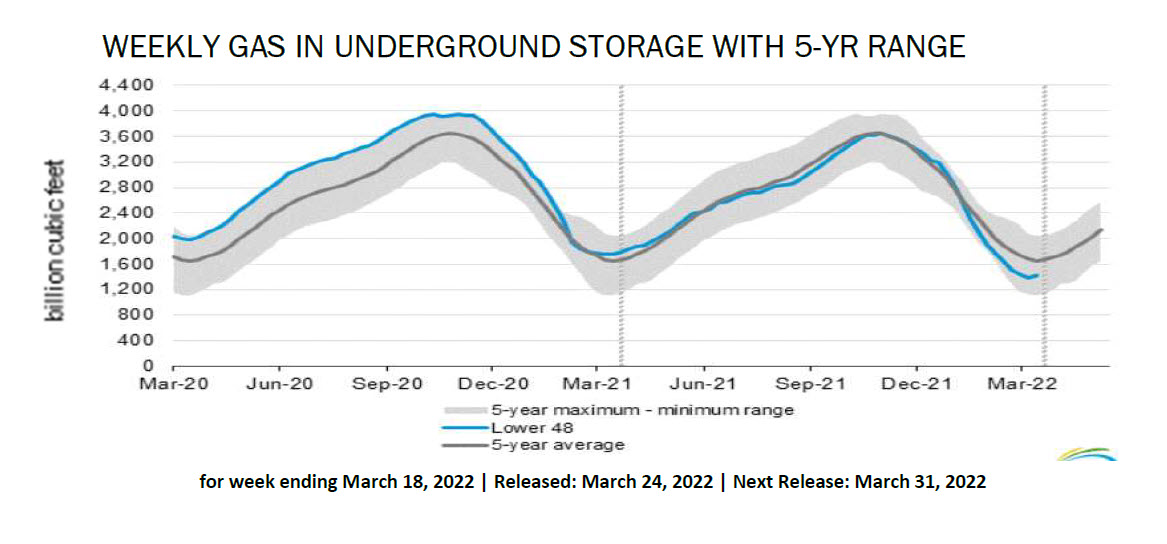

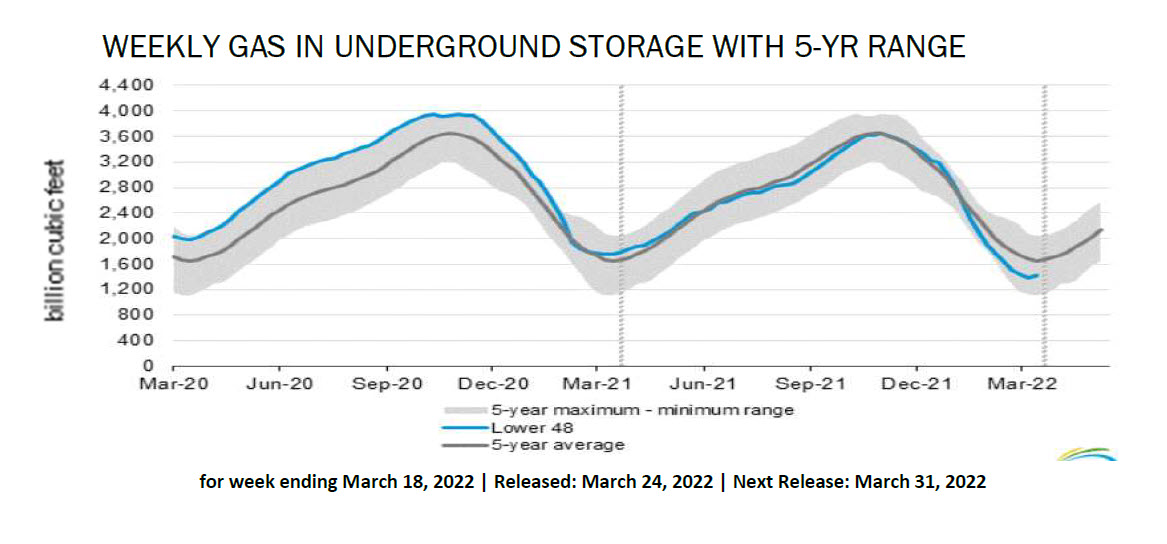

U.S. natural gas futures rose about 5% to a near-nine-week high on Wednesday as worries about Russia’s plan to price energy exports in roubles caused global energy prices to spike, keeping demand for U.S. liquefied natural gas (LNG) exports near record highs. That U.S. gas price gain came despite forecasts for milder weather and lower demand than previously expected, which should allow utilities to inject gas into storage next week. EIA/GASNGAS/POLL Germany on Wednesday triggered an emergency plan to manage gas supplies in Europe’s largest economy in an unprecedented move that could see the government ration power if there is a disruption or halt in gas supplies from Russia. That caused gas prices at the Title Transfer Facility (TTF) TRNLTTFMc1 in the Netherlands, the European benchmark, t… For more info go to https://bit.ly/3DvzCGO

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.