Major Consumers Considering Strategic Petroleum Release

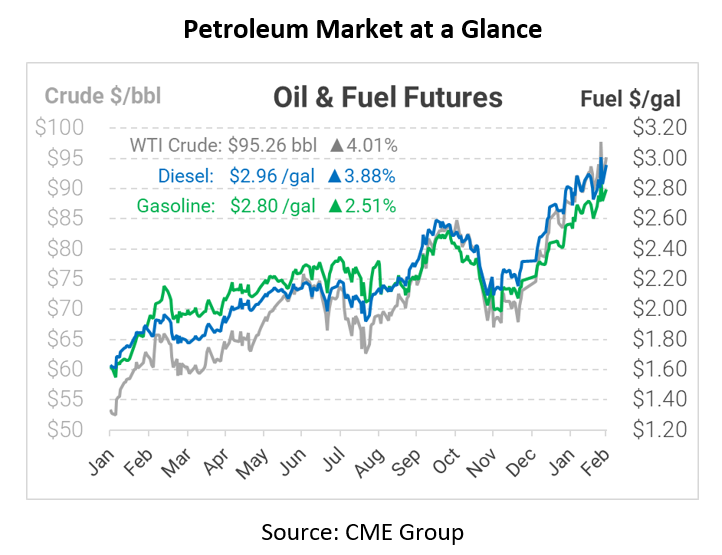

This morning oil prices are up, with crude reaching as high as $99.10 in the early morning. Higher prices come amid supply concerns that are directly associated with the ongoing Russian invasion of Ukraine and the sanctions being handed down on Russia. Due to severe supply worries from many major world oil consumers, these countries are now talking about potential strategic releases to ease the rising price of oil.

Similar to Biden’s release of 50 million barrels from the Strategic Petroleum Reserve in November 2021, other world powers and major oil consumers are considering doing the same to help ease prices for their people. Many of these potential countries are members of the International Energy Agency (IEA) and could agree later today or tomorrow on a plan to tap into their reserves. The United States would reportedly release 40 million barrels from its reserves while other member countries would make up the remaining 30 million. In a scheduled meeting later this week, it is expected that OPEC+ will increase their production output by another 400,000 bpd in April. With an insignificant price reduction in November from Biden’s release, all eyes now turn toward major oil consumers to see if these releases will make a difference in the future.

Today the Biden administration also announced that their Russian sanctions now prohibit Americans from doing any business with the Russian central bank. With these Russian assets essentially frozen in the states, Putin’s oligarchs are biting back and are frustrated with his lack of progress in the Ukrainian regions. With this strategic move, U.S. allies are expected to follow the steps of the American government in the coming days. While it took a bit longer than some expected, sanctions on Russia are now starting to take effect. Today the Russian ruble fell as low as 111 to the U.S. dollar from 83 on Friday, almost 20%.

As the US and EU add to the sanction’s regime, there is not much left to target except energy. Last week, prices rocketed higher on energy sanction fears, then sank when President Biden reported weaker financial penalties. Now, markets are once again pricing in the risk that the economic battle will extend to oil and gas. Sanctions would force a re-direct of oil flows, causing a temporary drain from inventories, adding to the problem of global supply and demand issues and limiting Russia’s ability to conduct business during this wartime event. With the Russian stock market going askew and sanctions starting to work effectively, the world awaits the next move of NATO countries if Putin continues on his same trajectory of a complete takeover of Ukraine.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.